For Week Ending October 19, 2019

For Week Ending October 19, 2019

While the U.S. Commerce Department reported that total housing starts dropped 9.4% month over month in September, that drop was focused on the apartment and condo segment while single-family housing starts actually rose .3%. Throughout much of the country, the continued low level of housing inventory is constraining sales activity from where it would be in a balanced market. Active inventory is in its normal seasonal decline, leaving buyers with fewer choices as we move towards the end of the year.

In the Twin Cities region, for the week ending October 19:

- New Listings decreased 6.1% to 1,309

- Pending Sales increased 6.5% to 1,138

- Inventory decreased 3.7% to 12,440

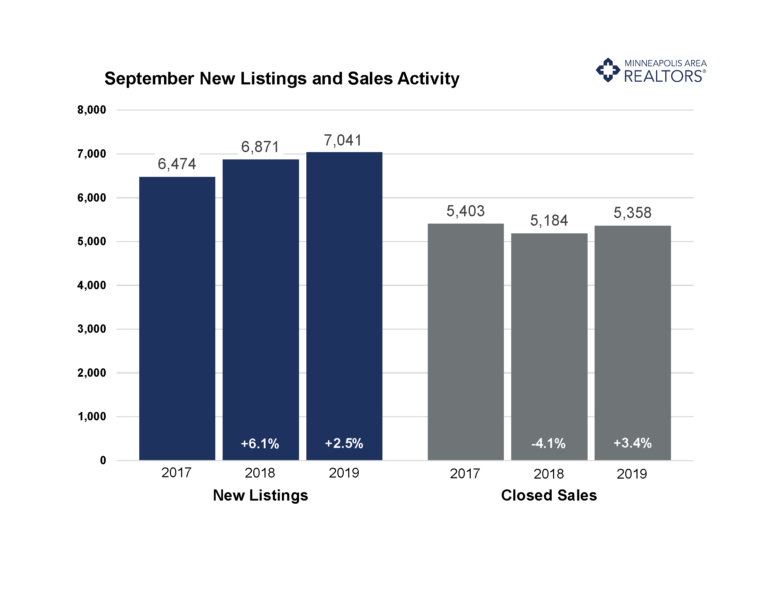

For the month of September:

- Median Sales Price increased 6.6% to $279,250

- Days on Market increased 2.4% to 43

- Percent of Original List Price Received increased 0.1% to 98.5%

- Months Supply of Homes For Sale decreased 3.7% to 2.6

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.