For Week Ending June 29, 2024

For Week Ending June 29, 2024

Nationally, the median down payment was $26,400, or 13.6% of the purchase price, in the first quarter of 2024, according to a recent study from Realtor.com, a slight decrease from the previous quarter, when the median down payment was $30,400 (14.7%). Down payments are up significantly from pre-pandemic levels: in the first quarter of 2020, the typical down payment was approximately $14,000, or 10.7% of the purchase price.

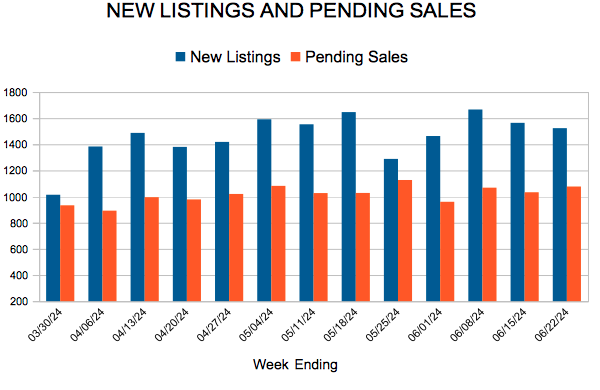

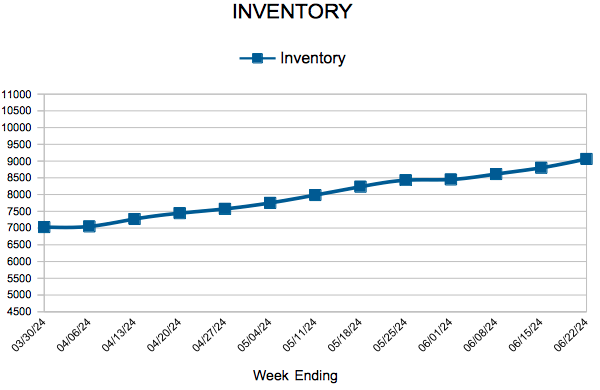

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 29:

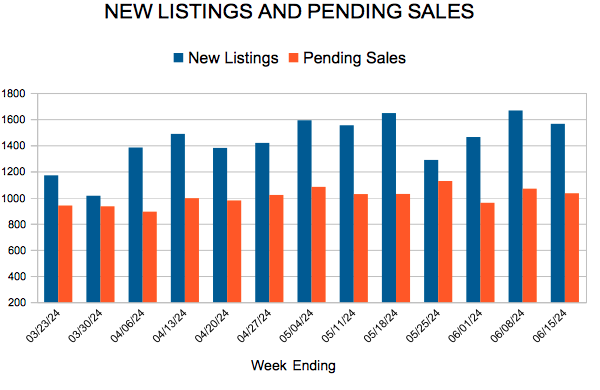

- New Listings increased 8.2% to 1,358

- Pending Sales decreased 12.0% to 1,061

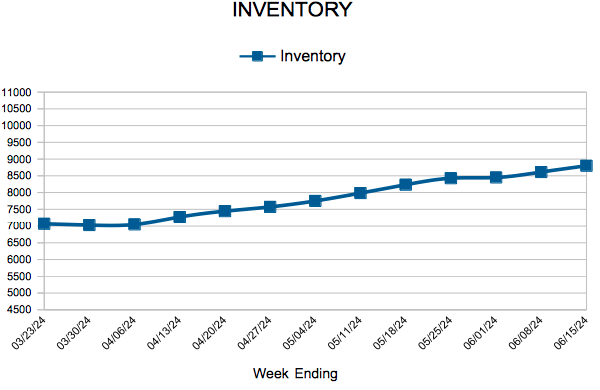

- Inventory increased 12.2% to 9,116

FOR THE MONTH OF MAY:

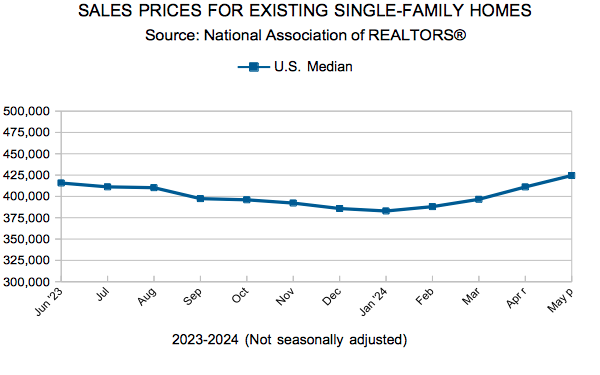

- Median Sales Price increased 4.1% to $385,000

- Days on Market increased 7.9% to 41

- Percent of Original List Price Received decreased 1.1% to 100.0%

- Months Supply of Homes For Sale increased 26.3% to 2.4

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.