For Week Ending May 8, 2021

For Week Ending May 8, 2021

The Mortgage Bankers Association’s latest National Delinquency Survey found the seasonally adjusted delinquency rate of one-to-four unit residential properties decreased to 6.38 percent of all loans outstanding in Q1 2021, which is 35 basis points lower than Q4 2020 but still 202 basis points higher than the same time last year. The COVID-19 induced delinquency rate peaked in Q2 2020 at 8.22 percent and over the last three quarters has experienced the quickest decline in the history of the survey. Although delinquencies remain elevated, the continued declines are encouraging and are expected to continue.

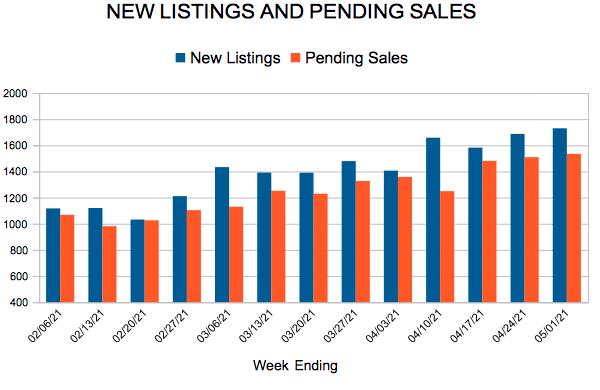

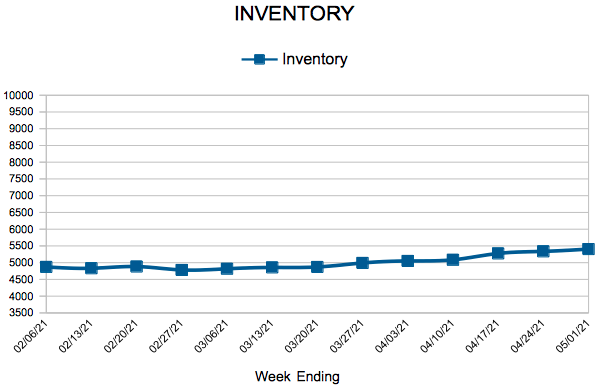

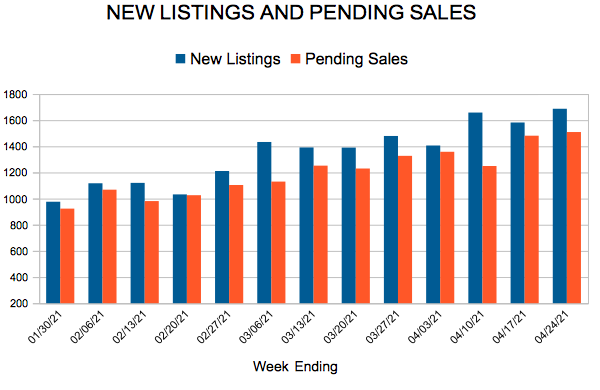

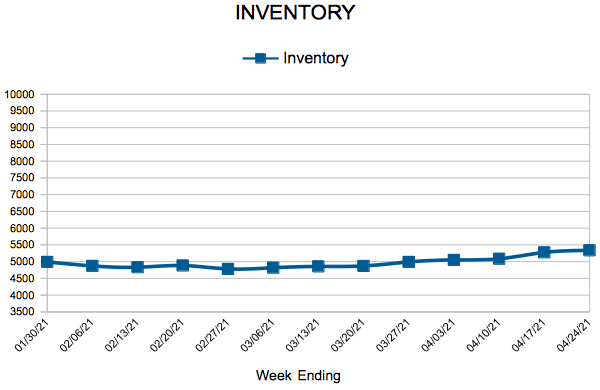

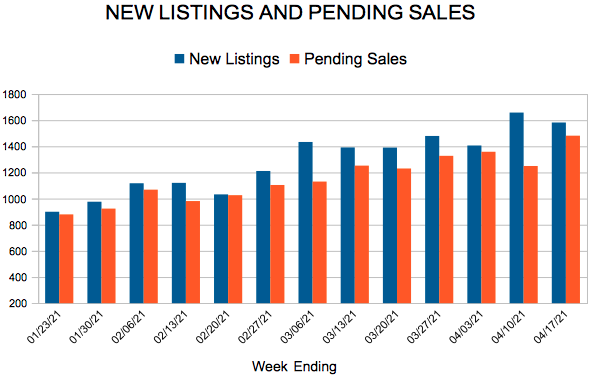

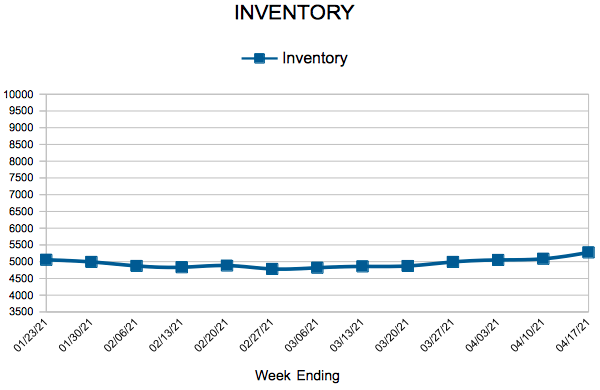

In the Twin Cities region, for the week ending May 8:

- New Listings increased 0.7% to 1,829

- Pending Sales increased 24.5% to 1,571

- Inventory decreased 47.0% to 5,524

For the month of April:

- Median Sales Price increased 10.5% to $337,000

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.5% to 103.4%

- Months Supply of Homes For Sale decreased 52.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.