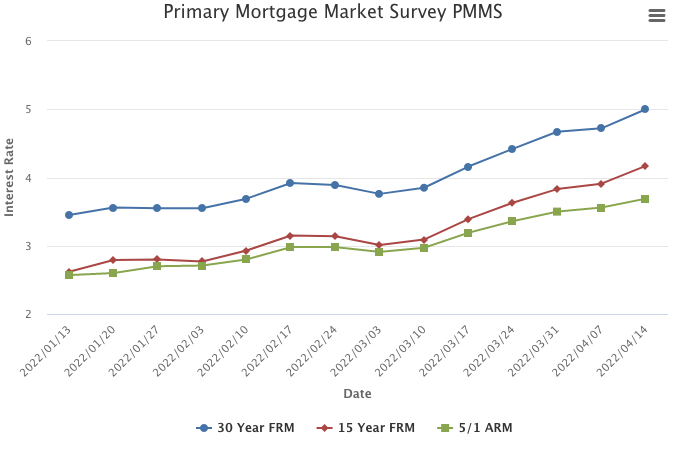

April 14, 2022

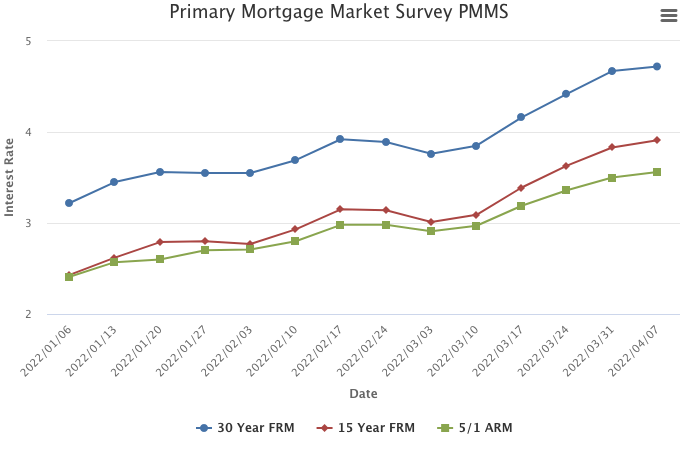

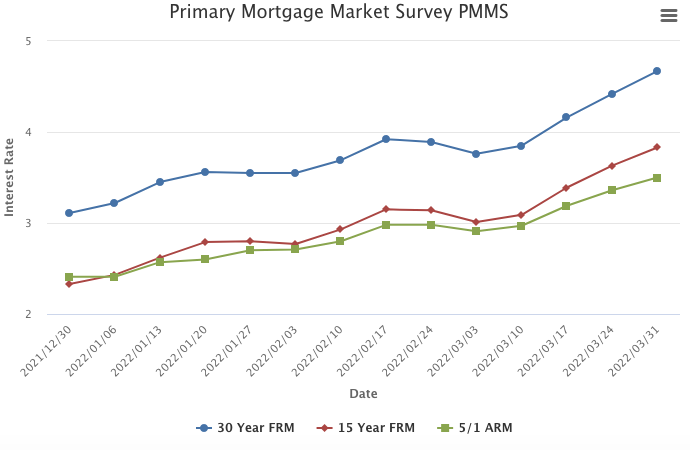

This week, mortgage rates averaged five percent for the first time in over a decade. As Americans contend with historically high inflation, the combination of rising mortgage rates, elevated home prices and tight inventory are making the pursuit of homeownership the most expensive in a generation.

Information provided by Freddie Mac.

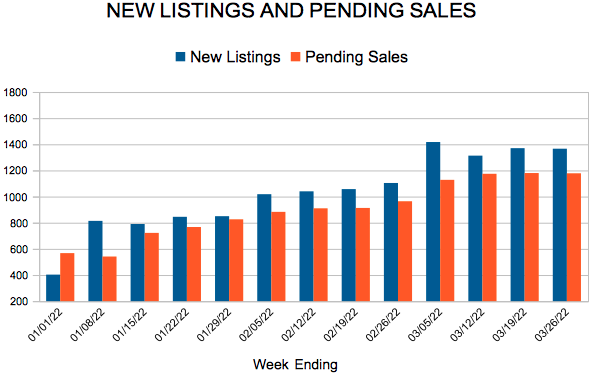

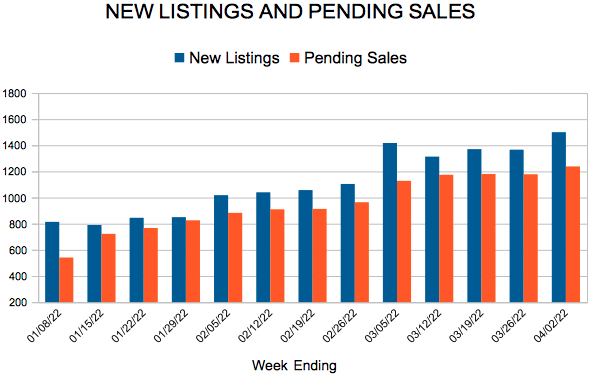

For Week Ending April 2, 2022

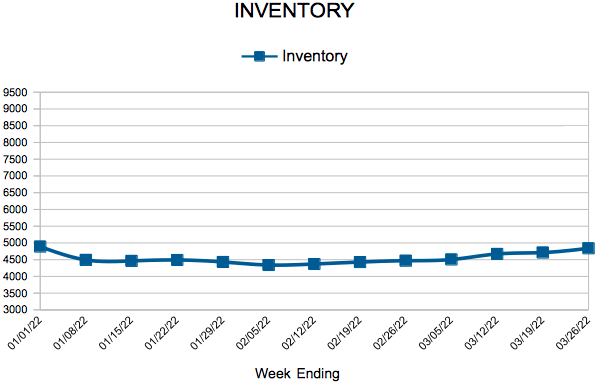

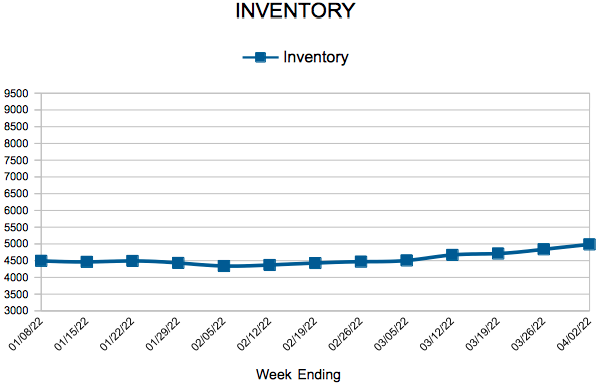

For Week Ending April 2, 2022