For Week Ending October 30, 2021

For Week Ending October 30, 2021

Millennials are leading the housing boom, accounting for 37% of home purchase over the last year, according to Barron’s. Increasing net worth, household formation, low mortgage rates, and a robust economy are a few of the reasons behind the recent growth of homebuyers in this age segment. With Millennials representing 22% of the U.S. population–and with their peak earning years ahead—experts remain optimistic about this generation’s impact on the housing market.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 30:

- New Listings increased 3.7% to 1,309

- Pending Sales increased 1.2% to 1,345

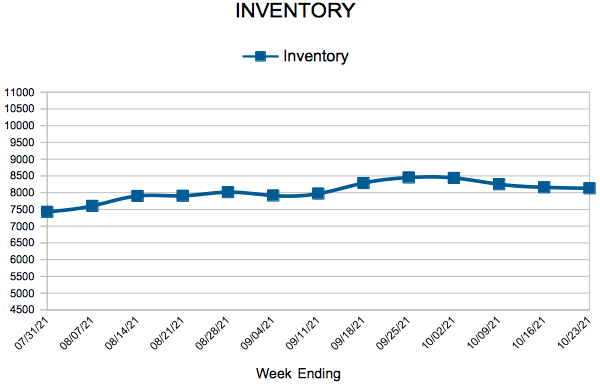

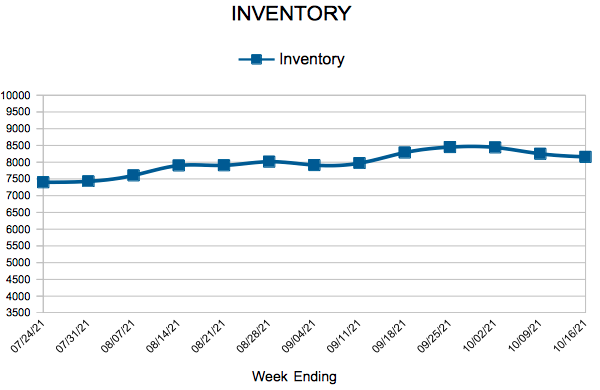

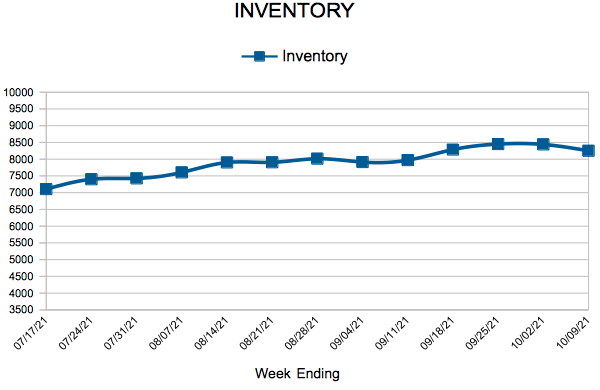

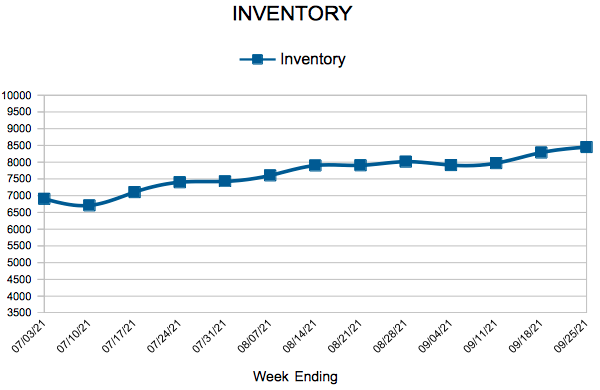

- Inventory decreased 13.8% to 8,025

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 9.9% to $340,700

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 15.8% to 1.6

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.