May 27, 2021

Mortgage rates are down below three percent, continuing to offer many homeowners the potential to refinance and increase their monthly cash flow. In fact, homeowners who refinanced their 30-year fixed-rate mortgage in 2020 saved more than $2,800 dollars annually. Substantial opportunity continues to exist today, as nearly $2 trillion in conforming mortgages have the ability to refinance and reduce their interest rate by at least half a percentage point.

Information provided by Freddie Mac.

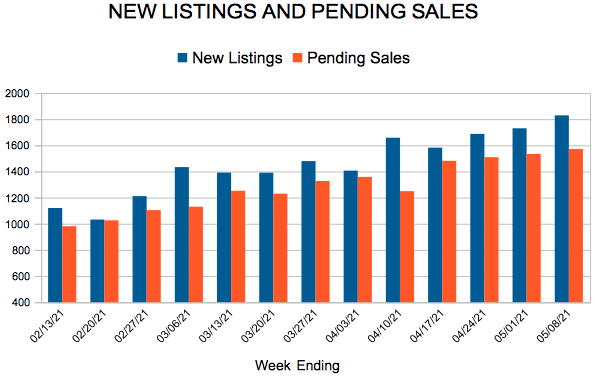

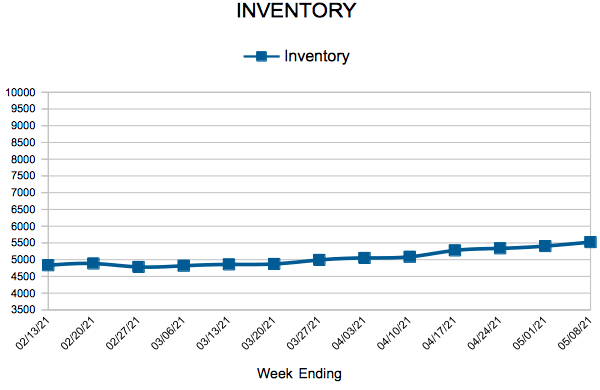

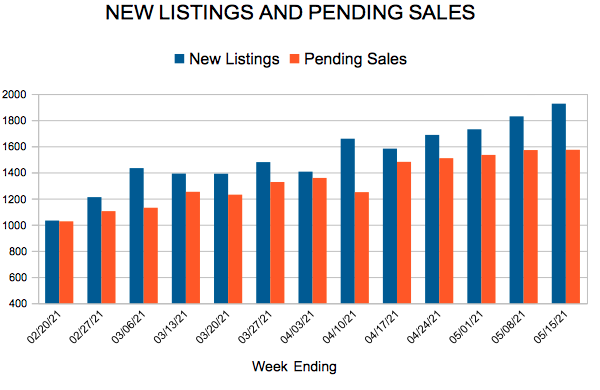

For Week Ending May 15, 2021

For Week Ending May 15, 2021