Weekly Market Report

For Week Ending June 10, 2023

For Week Ending June 10, 2023

Home price growth has slowed to its lowest rate on record since 2016, according to the latest Realtor.com Monthly Housing Trends Report. The U.S. median list price rose 2.56% month-over-month to $441,000 in May, representing a 0.9% increase from May 2022. Fluctuating mortgage interest rates and higher home prices continue to impact affordability, with monthly borrowing costs up approximately $296 in May compared to the same time last year, assuming a 20% borrower down payment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 10:

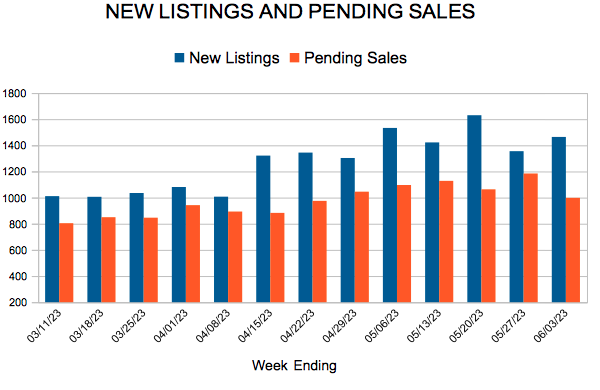

- New Listings decreased 15.4% to 1,573

- Pending Sales decreased 15.5% to 1,115

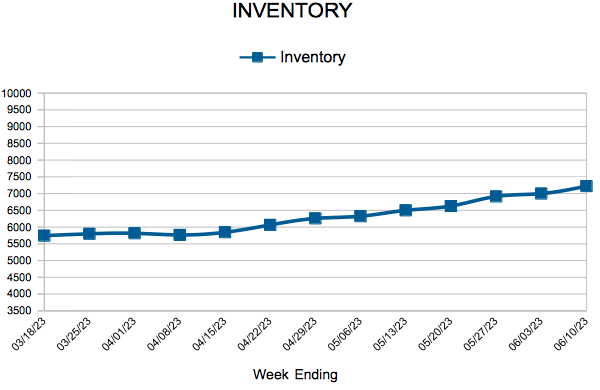

- Inventory decreased 8.7% to 7,224

FOR THE MONTH OF MAY:

- Median Sales Price decreased 1.3% to $370,000

- Days on Market increased 65.2% to 38

- Percent of Original List Price Received decreased 2.9% to 101.1%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Prices down slightly again while sellers still getting over asking price

- The median sales price was down 1.3 percent from last May to $370,000

- Signed purchase agreements fell 19.3 percent; new listings down 17.6 percent

- Sellers accepted offers for an average of 101.1 percent of their list price

(June 15, 2023) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, home prices dipped slightly from last May. Both buyer and seller activity were also lower compared to last year.

Sales & Prices

Prices were flat in April and down slightly in May. As in April, May sellers still accepted offers above their list price despite a decline in sales—a dynamic that reflects the persistently tight balance between supply and demand even in light of rising mortgage rates. While some sellers are still seeing multiple offers on well-presented listings, the offers were closer to 1.0 percent over list price versus 4.0 percent over list price last May. With half the homes selling in under 13 days, market times are up as demand has waned. And yet, homes are still selling faster than in May of 2019 and 2020.

Pending sales dipped 19.3 percent; closed sales fell 28.1 percent. Condo sales showed the largest drop while townhomes saw the smallest decline. Single family homes sold at a median of $405,000, townhomes at $311,000 and condos at $205,000. New home sales were flat while existing home sales were down. New homes sold for $461,000 while existing homes sold for $355,000. Sales under $500,000 decreased 20.4 percent while sales over $1M fell just 6.6 percent.

Home prices are up 25.5 percent since May 2020, but down 1.3 percent from May 2022. “It’s important to keep things in perspective,” said Jerry Moscowitz, President of Minneapolis Area REALTORS®. “The median price simply reflects the middle or typical home selling, but every home is unique. In some ways, this pause gives buyers some room to be more selective on the listings that really stand out.”

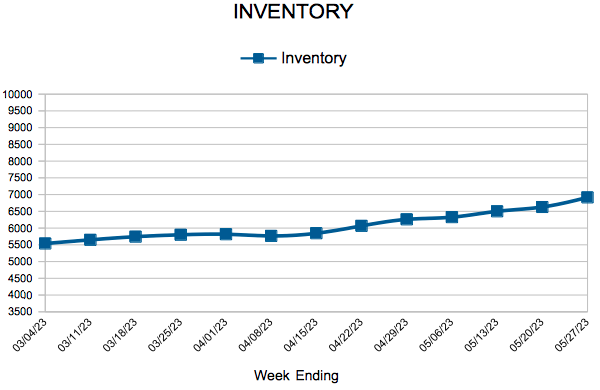

Listings and Inventory

In May, sellers brought 17.6 percent fewer new listings online than last year—the smallest decline in four months. Inventory levels slid 9.0 percent lower. Some sellers are choosing to stay put and wait instead of selling for a lower price. Most sellers are also buyers and are reluctant to trade away their 3.0 percent interest rate for 6.8 percent. “While rates are surely a factor in decision-making, don’t lose sight of other factors like changes in lifestyle, a new job, growing or shrinking households, separations and so on,” said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “Economists’ interest rate forecasts vary widely; nobody knows what will happen. If you buy and rates go down you can refinance, if they go up, you’ll be glad you didn’t wait. We’re still below the average 30-year mortgage interest rate over the last 50 years.”

Sellers are also still getting good offers fairly quickly. At a median of 13 days, homes are still selling even faster than in May 2020—there are just fewer sales. But, there are also fewer listings. Both supply and demand downshifting together means the balance between buyer and seller activity has remained tight. And those sellers accepted offers at 101.1 percent of their list price—down from 104.1 percent from last May but clearly still a strong figure. The Twin Cities metro remains a seller’s market, just not to the same degree as last year. The 1.8 months supply of inventory for May was up 28.6 percent. Typically 4-6 months of supply are needed to achieve a balanced, neutral market.

Location & Property Type

Market activity varies by area, price point and property type. New home sales rose 34.6 percent while existing home sales were down 23.0 percent. Single family sales fell 23.6 percent, condo sales declined 8.5 percent and townhome sales were down 3.9 percent. Sales in Minneapolis decreased 13.1 percent while Saint Paul sales fell 29.8 percent. Cities such as Watertown, Medina, Corcoran, Dayton and Shakopee saw the largest sales gains while Buffalo, Monticello, Cambridge and Zimmerman all had notably lower demand than last year.

For more information on weekly and monthly housing numbers visit www.mplsrealtor.com or www.spaar.com

May 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 6,645 properties on the market, a 17.6 percent decrease from last May

- Buyers signed 4,901 purchase agreements, down 19.3 percent (3,994 closed sales, down 28.1 percent)

- Inventory levels shrank 9.0 percent to 6,864 units

- Month’s Supply of Inventory rose 28.6 percent to 1.8 months (4-6 months is balanced)

- The Median Sales Price softened 1.3 percent to $370,000

- Days on Market rose 65.2 percent to 38 days, on average (median of 13 days, up 85.7 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 23.6 percent; Condo sales were down 8.5 percent & townhouse sales fell 3.9 percent

- Traditional sales declined 19.6 percent; foreclosure sales rose 67.9 percent; short sales decreased 33.3 percent (12 to 8)

- Previously owned sales were down 23.0 percent; new construction sales rose 34.6 percent

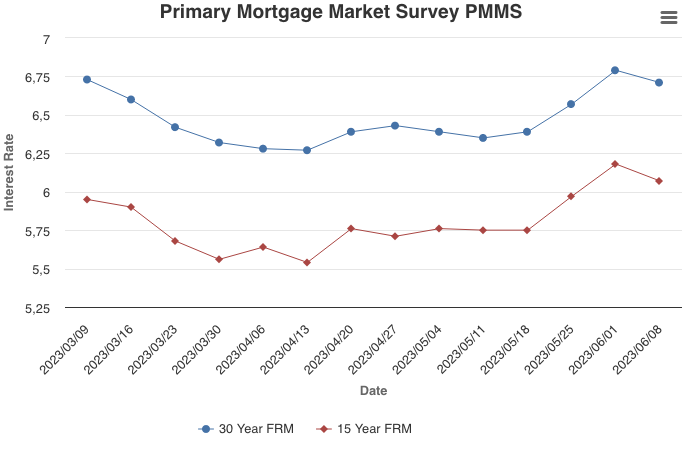

Mortgage Rates Continue to Come Down

June 15, 2023

Mortgage rates decreased slightly this week in anticipation of the pause in rate hikes by the Federal Reserve. As inflation continues to decelerate, economic growth is slowing and the tightening cycle of monetary policy is reaching its apex, which means mortgage rates are expected to decrease later this year and into next.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 3, 2023

For Week Ending June 3, 2023

Builder confidence continues to rise thanks to a boost in new-home sales, as a limited supply of existing homes for sale has helped drive demand for new homes this year. According to the National Association of Home Builders (NAHB), builder sentiment rose 5 points in May to 50, the fifth consecutive monthly increase and the highest level recorded since July 2022. With interest rates up compared to this time last year, builders’ use of sales incentives has played an important role in attracting buyers, with an average price reduction of 6% reported among the builders surveyed.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 3:

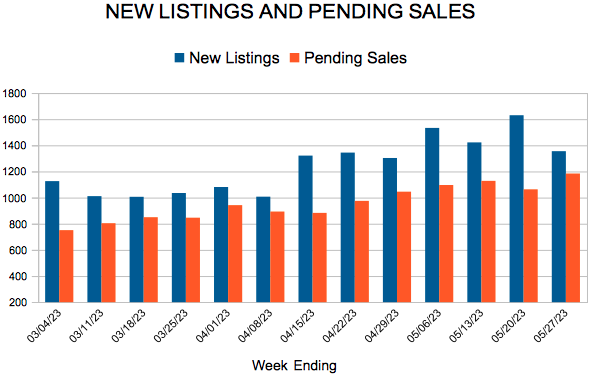

- New Listings decreased 20.7% to 1,464

- Pending Sales decreased 9.8% to 998

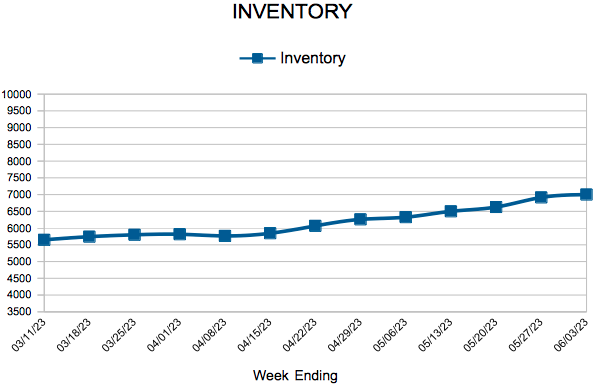

- Inventory decreased 6.7% to 7,000

FOR THE MONTH OF APRIL:

- Median Sales Price remained flat at $369,900

- Days on Market increased 64.3% to 46

- Percent of Original List Price Received decreased 3.6% to 100.1%

- Months Supply of Homes For Sale increased 33.3% to 1.6

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Decline After a Three-Week Ascent

June 8, 2023

Mortgage rates decreased after a three-week climb. While elevated rates and other affordability challenges remain, inventory continues to be the biggest obstacle for prospective homebuyers.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 54

- 55

- 56

- 57

- 58

- …

- 119

- Next Page »