For Week Ending January 8, 2022

For Week Ending January 8, 2022

Mortgage rates rose to their highest level since May 2020, with the 30-year fixed rate mortgage averaging 3.22% during the first week of 2022, more than half a percent higher than January 2021. The increase in interest rates has had little effect on buyer demand, which remains high into the new year, as purchase loan applications were up 1.4% on a seasonally adjusted basis the same week, according to the Mortgage Bankers Association’s Market Composite Index.

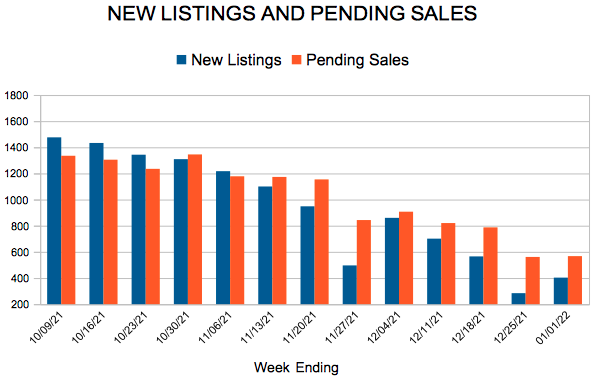

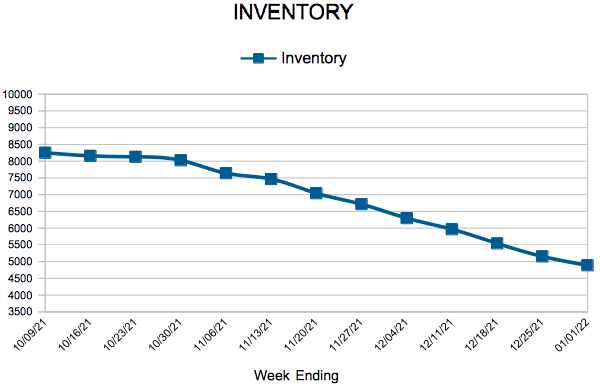

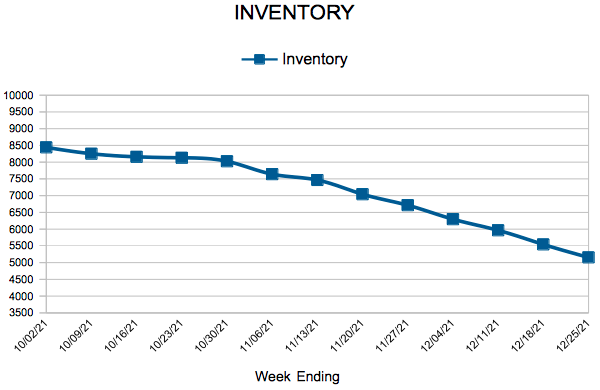

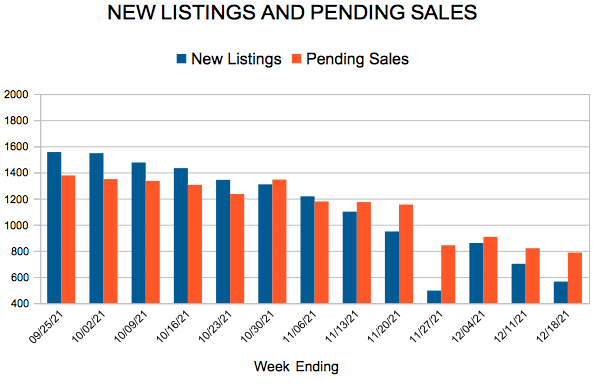

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 8:

- New Listings decreased 16.2% to 814

- Pending Sales decreased 19.1% to 541

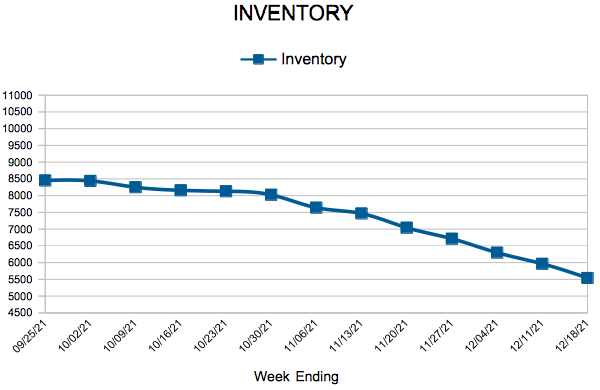

- Inventory decreased 22.5% to 4,493

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.9% to $331,200

- Days on Market decreased 15.4% to 33

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 27.3% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.