Metro home prices hit record high despite higher rates and more inventory

- Signed purchase agreements fell 10.8%; new listings down 5.8%

- The median sales price increased 1.8% to $390,000

- Market times rose 9.7% to 34 days; inventory up 10.6% to 8,905

(Jul. 16, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, listings rose slightly compared to last year while sales softened. Inventory levels and prices were up.

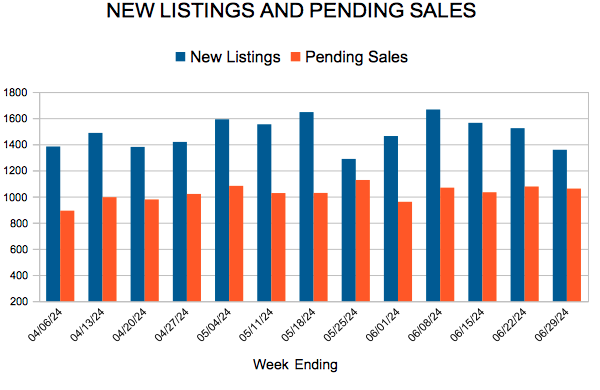

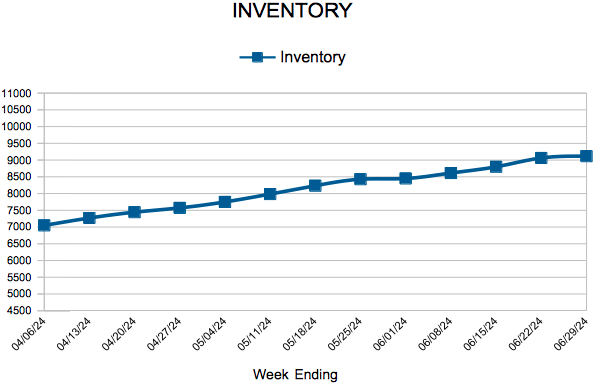

Sellers, Buyers and Housing Supply

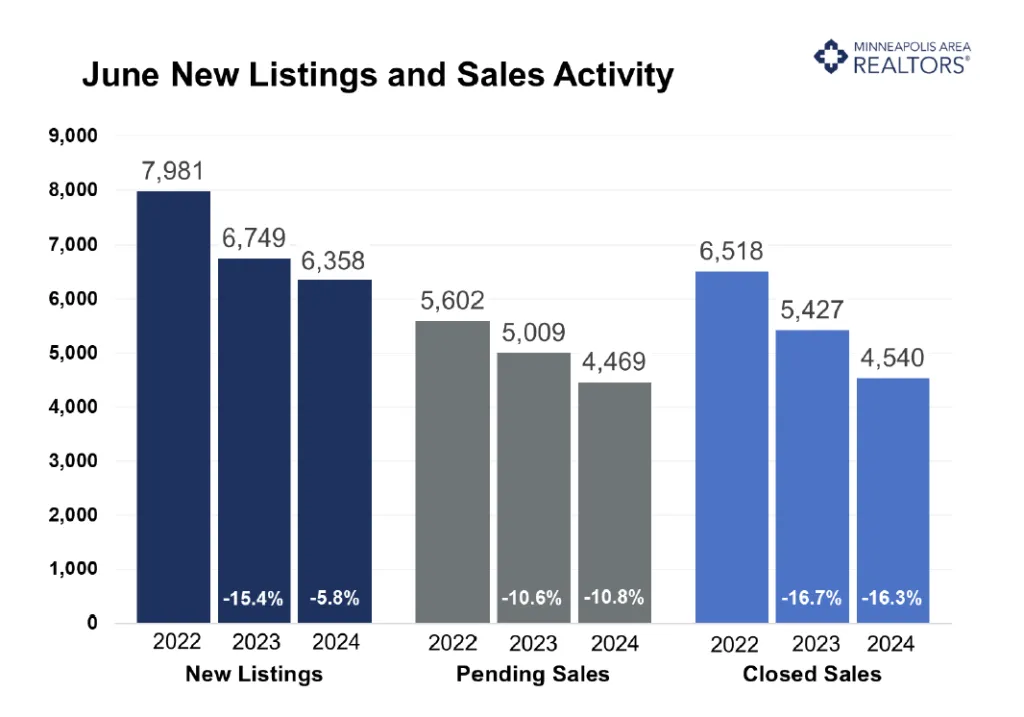

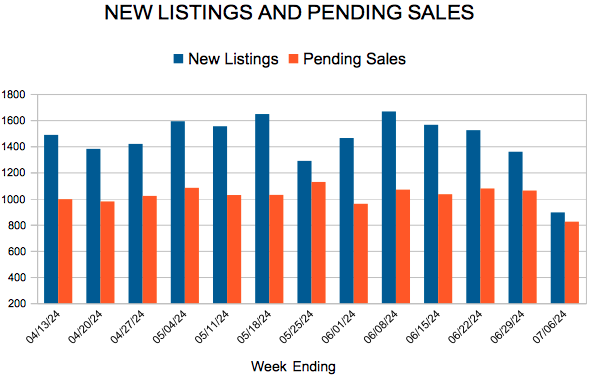

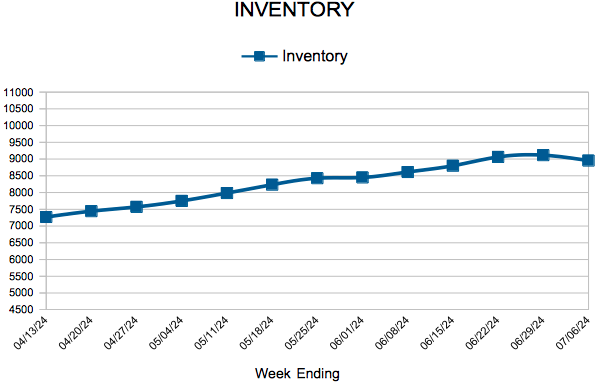

It’s official. Half of 2024 is in the books. That makes it a good time to zoom out and check on some year-to-date figures. So far this year, there have been 10.6% more new listings and 1.8% more pending sales metro-wide compared to the same period last year. That means seller activity has risen more than five times the pace of buyer activity on a year-to-date basis. Put another way, there was more supply coming online relative to demand—a trend confirmed by eight consecutive months of inventory growth. For June, the number of homes for sale was up 10.6% to 8,905 active listings. That’s the number of listings on which buyers can write offers. While buyers may be feeling less pressure with 850 additional homes to choose from, there are still only 2.4 months of supply, indicating a seller’s market; a balanced market is 4-6 months of inventory.

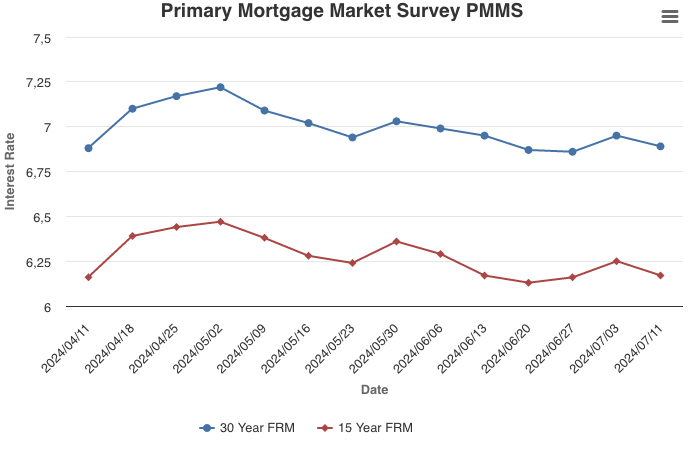

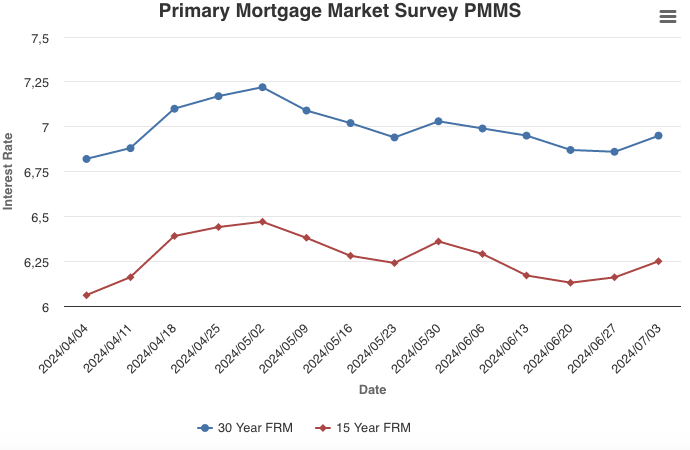

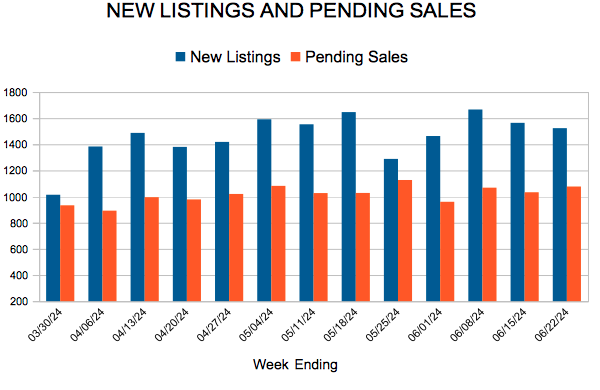

While this year has seen growth in both listings and sales compared to 2023, there seems to have been a cool-down in activity in May and June as signed purchase agreements dipped. At around 7.0%, mortgage rates in May and June of this year hovered higher than last year. And buyers are still feeling the triple punch of rising prices, low inventory and higher interest rates. There is a good amount of pent-up buyer and seller activity waiting in the wings for an improved affordability picture.

But all situations are unique. For example, move-up buyers with built up equity from their first home can roll that equity into their next property, while most first-time buyers don’t have that luxury. Additionally, market inventory and high interest rates lead to a decrease in overall activity, especially when it comes to more affordable homes as those buyers are the most rate sensitive.

Prices, Market Times and Negotiations

Listings in some areas are still getting multiple offers and selling for over list price. In fact, overall, sellers accepted offers at 100.1% of their list price on average. While perhaps surprisingly strong, that was down from last year. And those offers came in after an average of 34 days on market, which was up from last year. Single family homes specifically are selling after 31 days but condos are taking 56 days. “This is still a somewhat fragmented market where activity truly varies from price point to price point and area to area,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “While we’re encouraged by more supply, the lack of affordability caused by higher mortgage rates and rising prices are still significant hurdles.”

The median home price was up 1.8% to $390,000. That was the smallest gain since December. The single-family median price rose to $425,000, while condos fell to just under $200,000 and townhomes dipped to $310,000. New home prices are just over $500,000 while existing home prices are $380,000. Low inventory and the mix of product selling—i.e. more luxury and new construction—are partly what’s keeping prices so firm. “We are observing that the limited inventory is still affecting prices and activity for more affordable properties,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “Partnering with a qualified and experienced professional will help consumers navigate the intricacies of this market.”

Location & Property Type

Market activity always varies by area, price point and property type. New home sales outperformed existing home sales while condo sales fell by over twice as much as single family. Sales over $500,000 performed better than sales under $500,000. Cities such as Mahtomedi, Hudson and North Oaks saw among the largest sales gains while Delano, Annandale and Elko New Market all had notably weaker demand. For cities with at least five sales, the highest priced areas were Deephaven, Shorewood, Tonka Bay and North Oaks while the most affordable areas were Hopkins, St. Paul Park and Spring Lake Park.

May 2024 Housing Takeaways (compared to a year ago)

- Sellers listed 6,358 properties on the market, a 5.8% decrease from last June

- Buyers signed 4,469 purchase agreements, down 10.8% (4,540 closed sales, down 16.3%)

- Inventory levels increased 10.6% to 8,905 units

- Month’s Supply of Inventory rose 14.3% to 2.4 months (4-6 months is balanced)

- The Median Sales Price was up 1.8% to $390,000

- Days on Market rose 9.7% to 34 days, on average (median of 15 days, up 25.0%)

- Changes in Pending Sales activity varied by market segment and price point

- Single family sales fell 8.5%; condo sales were down 21.1%; townhouse sales decreased 17.2%

- Traditional sales were down 10.5%; foreclosure sales declined 34.2% to 25; short sales rose 25.0% to 5

- Previously owned sales decreased 11.6%; new construction sales were up 0.2%

- Sales under $500,000 declined 13.2%; sales over $500,000 decreased 2.5%

For Week Ending July 6, 2024

For Week Ending July 6, 2024