Listings are up more than sales meaning buyers are seeing more options

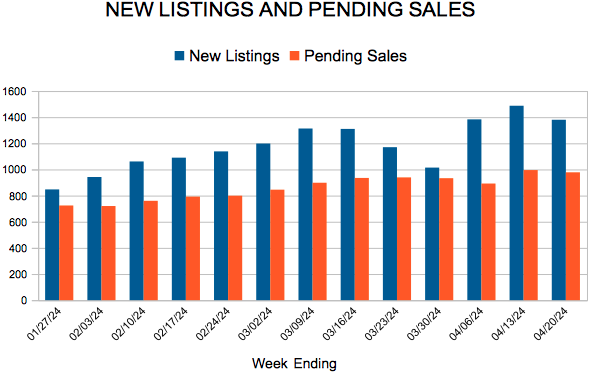

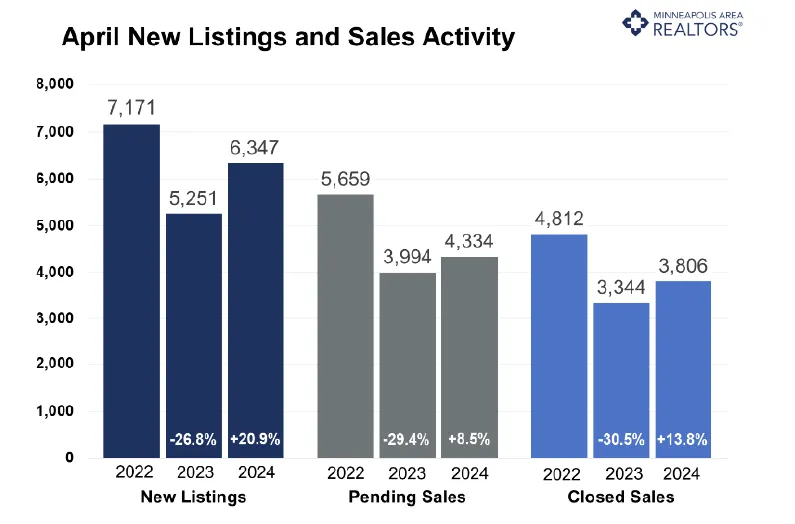

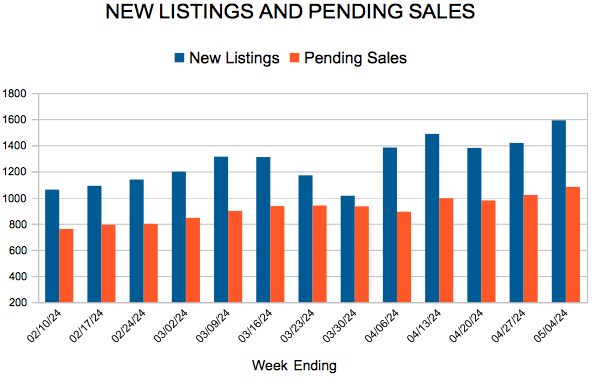

- Signed purchase agreements rose 8.5%; new listings up 20.9%

- The median sales price increased 4.1% to $385,250

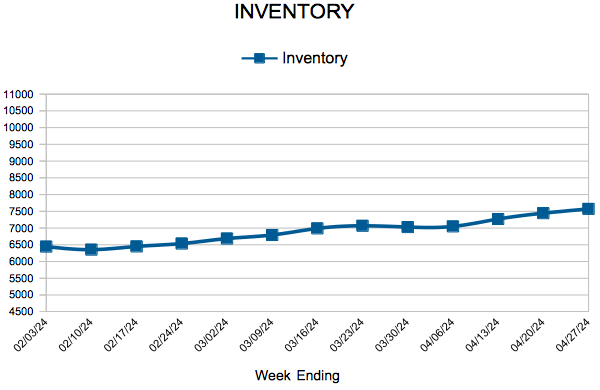

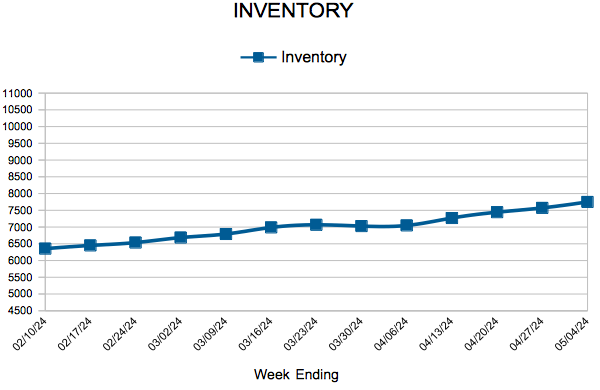

- Market times fell 2.2% to 45 days; inventory up 14.1% to 7,705

(May 15, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, both listings and sales rose compared to last year at this time. Prices and inventory levels were also higher.

Sellers, Buyers and Housing Supply

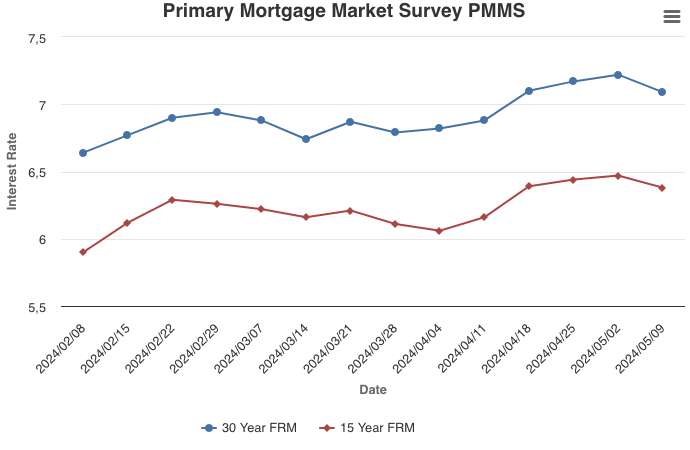

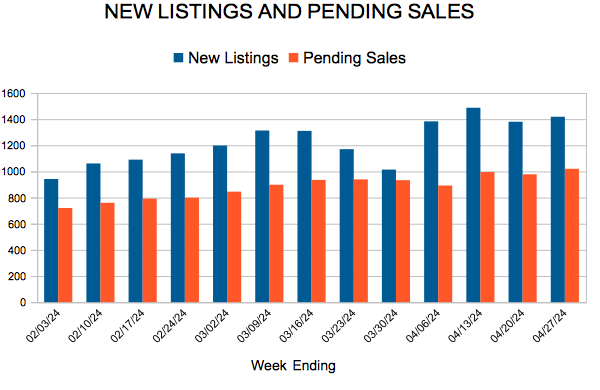

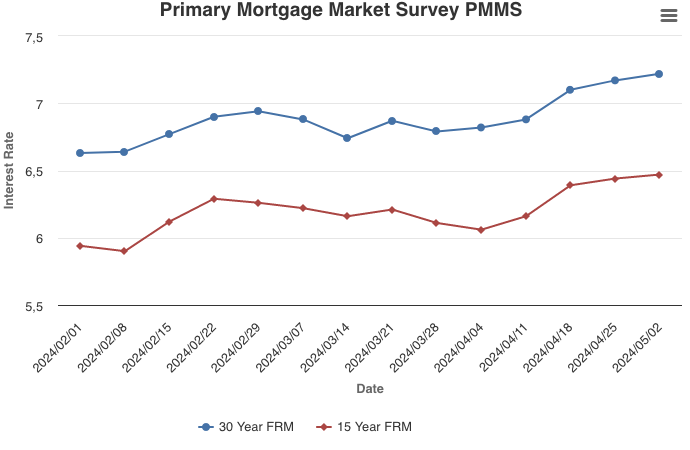

(May 15, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, both listings and sales rose compared to last year at this time. Prices and inventory levels were also higher. Sellers, Buyers and Housing Supply May and June tend to be the busiest times of year for buying and selling homes. This year has seen growth in both listings and sales compared to 2023. Through April, seller activity is up 19.3% while buyer activity is up 9.1%. For April alone, those figures are 20.9% and 8.5% respectively. Since listings are rising faster than sales, inventory levels are on the rise, recently up 14.1% to 7,705 active listings. That’s the highest number of actively marketed listings since November. While buyers are still feeling squeezed by rates just over 7.0%, pent-up activity for both buyers and sellers is being released as we’re comparing to an already low baseline.

Even with that increase in inventory, we’d need about 20,000 active listings to have a balanced market and we have under 8,000. But not all price points behave the same. There are 1.6 months of supply of homes under $250,000 but 6.2 months of supply of homes over $1 million (4-6 months is balanced). Move-up buyers with built-up equity from their first home are able to roll that into the next property, while first-time buyers don’t have that luxury. So, the most affordable price points have seen the largest declines in demand—but that’s also a result of having the tightest supply levels. Luxury buyers are less impacted by rates and therefore the upper price ranges are seeing the largest gains in demand. Some well-capitalized buyers are combating higher rates by skipping the mortgage entirely and using cash. About 17.5% of Twin Cities homes are purchased in cash but it’s nearly double that for properties over $1 million.

Prices, Market Times and Negotiations

Again, depending on price point, well-presented listings in many areas are getting multiple offers. Overall, sellers accepted offers just shy of full list price (99.9%), which was actually down a hair from last year. Moreover, they got those offers after an average of 45 days on market, which was faster than last year. That also varied by price point and area. Single family homes are selling after 43 days but condos are taking 74 days. “This is a market where both sides really can be successful with their needs but may not get all of their wants,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “It’s okay to be excited about more inventory, but people should know that we still have an undersupplied market which means sellers have the advantage overall.”

The median home price was up 4.1% to $385,250. Single family prices stood at $425,000, condo prices hovered around $217,000 and townhomes checked in at $312,000. New home prices are just shy of $500,000 while existing home prices are $370,000. Even as prices remain firm, some sellers are finding themselves paying closing costs or doing other buyer incentives to get transactions across the closing table. “While we don’t have enough homes for everyone who wants one, I am seeing more traffic at open houses and additional buyers are coming into (or returning to) the market,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “Many buyers are more cautious and realistic today, yet they are still excited to become homeowners.”

Location & Property Type

Market activity always varies by area, price point and property type. Existing home sales rose faster than new home sales. Condo sales rose nearly three times as much as single family. Sales over $500,000 rose at six times the rate of sales under $500,000. Cities such as Robbinsdale, Columbia Heights and Corcoran saw among the largest sales gains while Forest Lake, Victoria and Delano all had notably weaker demand. For cities with at least five sales, the highest priced areas were Medina, Lake Elmo and Orono while the most affordable areas were Red Wing, Mora, Columbia Heights and Faribault.

March 2024 Housing Takeaways (compared to a year ago)

-

- Sellers listed 6,347 properties on the market, a 20.9% increase from last April

- Buyers signed 4,334 purchase agreements, up 8.5% (3,806 closed sales, up 13.8%)

- Inventory levels increased 14.1% to 7,705 units

- Month’s Supply of Inventory rose 17.6% to 2.0 months (4-6 months is balanced)

- The Median Sales Price was up 4.1% to $385,250

- Days on Market was down 2.2% to 45 days, on average (median of 18 days, up 5.9%)

- Changes in Pending Sales activity varied by market segment and price point

- Single family sales rose 9.3%; condo sales were up 25.5%; townhouse sales increased 1.2%

- Traditional sales were up 8.5%; foreclosure sales rose 39.4% to 46; short sales were flat at 6

- Previously owned sales increased 9.8%; new construction sales were up 2.5%

- Sales under $500,000 rose 3.6%; sales over $500,000 increased 24.2%

For Week Ending May 4, 2024

For Week Ending May 4, 2024