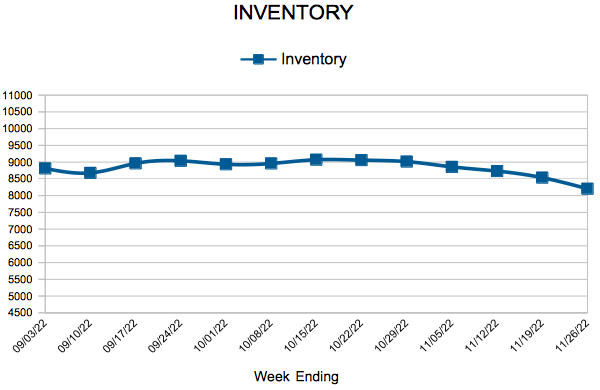

Inventory

Weekly Market Report

For Week Ending November 26, 2022

For Week Ending November 26, 2022

The share of first-time homebuyers has fallen to an all-time low, with first-time buyers making up 26% of all buyers for the fiscal year ending June 2022, while the age of the typical first-time buyer increased to 36 years old, an all-time high, according to the National Association of REALTORS® Profile of Home Buyers and Sellers, which has been published since 1981. Higher borrowing costs and a lack of affordable housing have forced many buyers out of the market this year, and inflation and rising rents have made it more difficult to save up for a down payment.

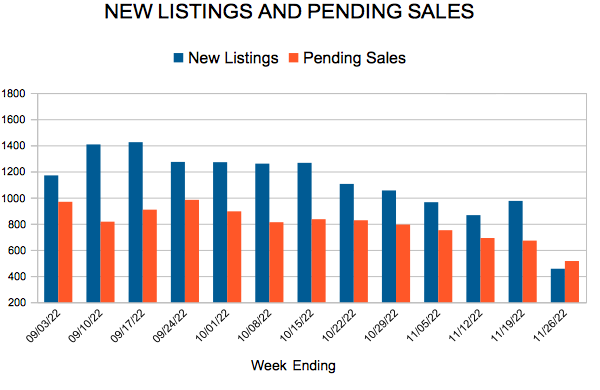

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 26:

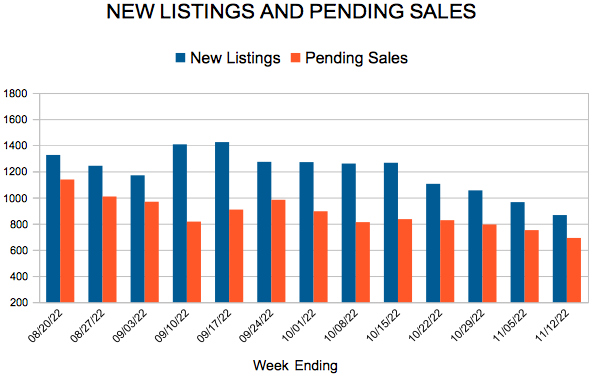

- New Listings decreased 10.4% to 456

- Pending Sales decreased 39.8% to 515

- Inventory increased 12.3% to 8,205

FOR THE MONTH OF OCTOBER:

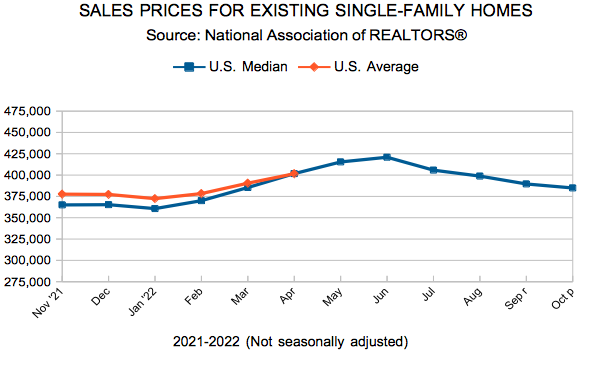

- Median Sales Price increased 4.6% to $355,500

- Days on Market increased 33.3% to 36

- Percent of Original List Price Received decreased 2.0% to 98.3%

- Months Supply of Homes For Sale increased 33.3% to 2.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

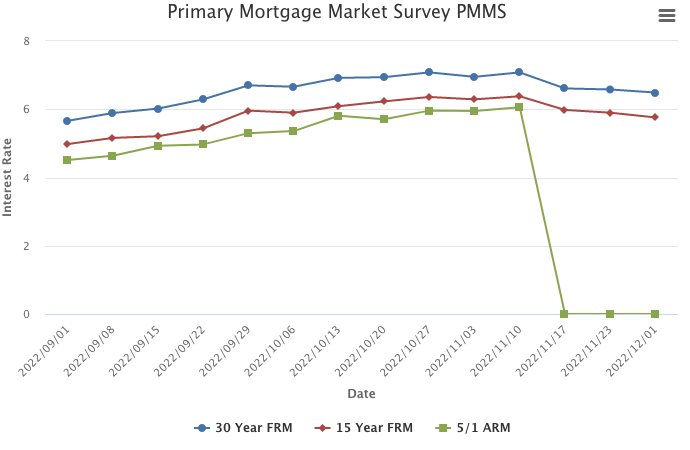

Mortgage Rates Continue to Decrease

December 1, 2022

Mortgage rates continued to drop this week as optimism grows around the prospect that the Federal Reserve will slow its pace of rate hikes. Even as rates decrease and house prices soften, economic uncertainty continues to limit homebuyer demand as we enter the last month of the year.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

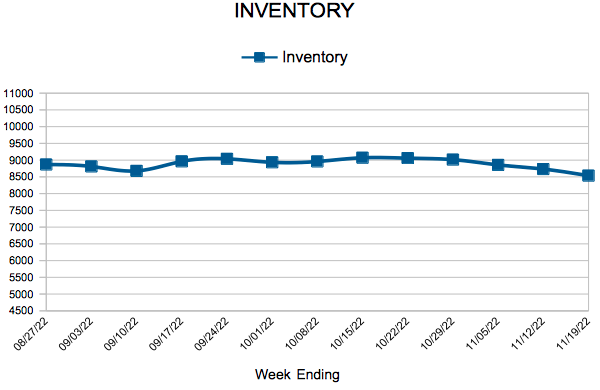

Weekly Market Report

For Week Ending November 19, 2022

For Week Ending November 19, 2022

Housing supply continues to grow nationwide, as higher borrowing costs cause home sales to slow. According to Realtor.com’s Monthly Housing Market Trends Report, the national inventory of active listings increased 33.5% year-over-year in October, the highest inventory level since 2020. As a result, local buyers may find they have more options to choose from, and with homes spending more days on market compared to the same period last year, a bit more time to shop around as well.

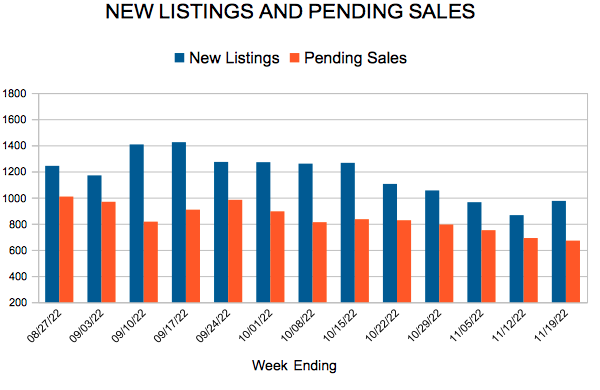

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 19:

- New Listings decreased 1.8% to 975

- Pending Sales decreased 42.6% to 671

- Inventory increased 11.6% to 8,536

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.6% to $355,500

- Days on Market increased 33.3% to 36

- Percent of Original List Price Received decreased 2.0% to 98.3%

- Months Supply of Homes For Sale increased 26.7% to 1.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

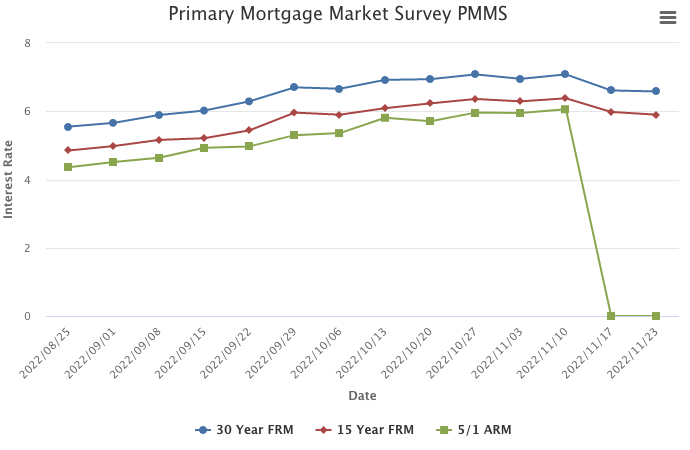

Mortgage Rates Tick Down

November 23, 2022

Mortgage rates continued to tick down heading into the Thanksgiving holiday. In recent weeks, rates have hit above seven percent only to drop by almost half a percentage point. This volatility is making it difficult for potential homebuyers to know when to get into the market, and that is reflected in the latest data which shows existing home sales slowing across all price points.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 58

- 59

- 60

- 61

- 62

- …

- 111

- Next Page »