Weekly Market Report

For Week Ending November 9, 2024

For Week Ending November 9, 2024

U.S. pending home sales increased 7.4% month-over-month and 2.6% year-over-year, as falling mortgage rates in August and September helped under contract sales rise to their highest level since March, according to the National Association of REALTORS®. Pending sales were up in all four regions of the country, with the West posting the highest monthly gain at 9.8%.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 9:

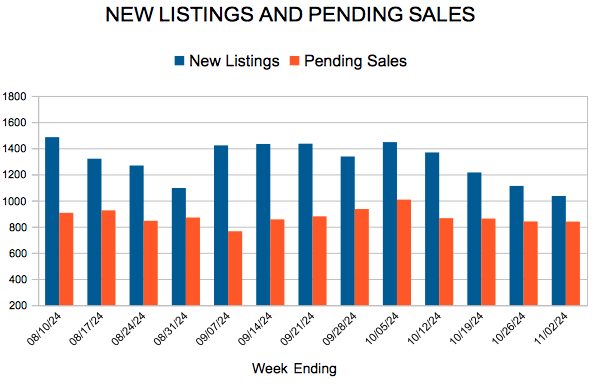

- New Listings increased 1.2% to 1,004

- Pending Sales increased 15.0% to 721

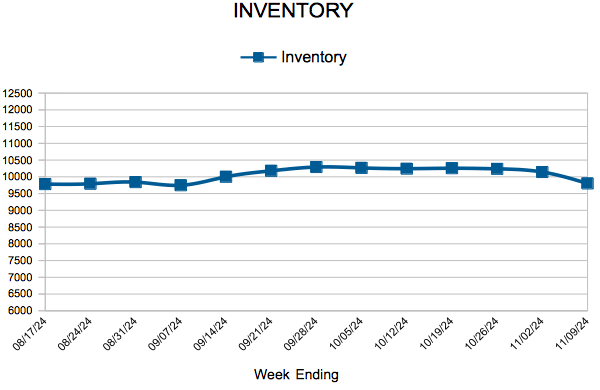

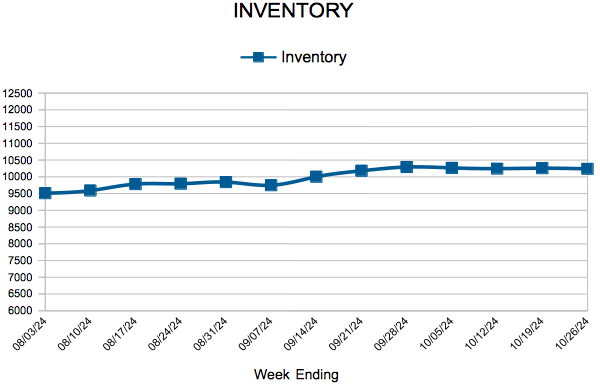

- Inventory increased 7.1% to 9,802

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.1% to $380,000

- Days on Market increased 21.6% to 45

- Percent of Original List Price Received decreased 0.7% to 97.8%

- Months Supply of Homes For Sale increased 8.0% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

October Housing Market Update

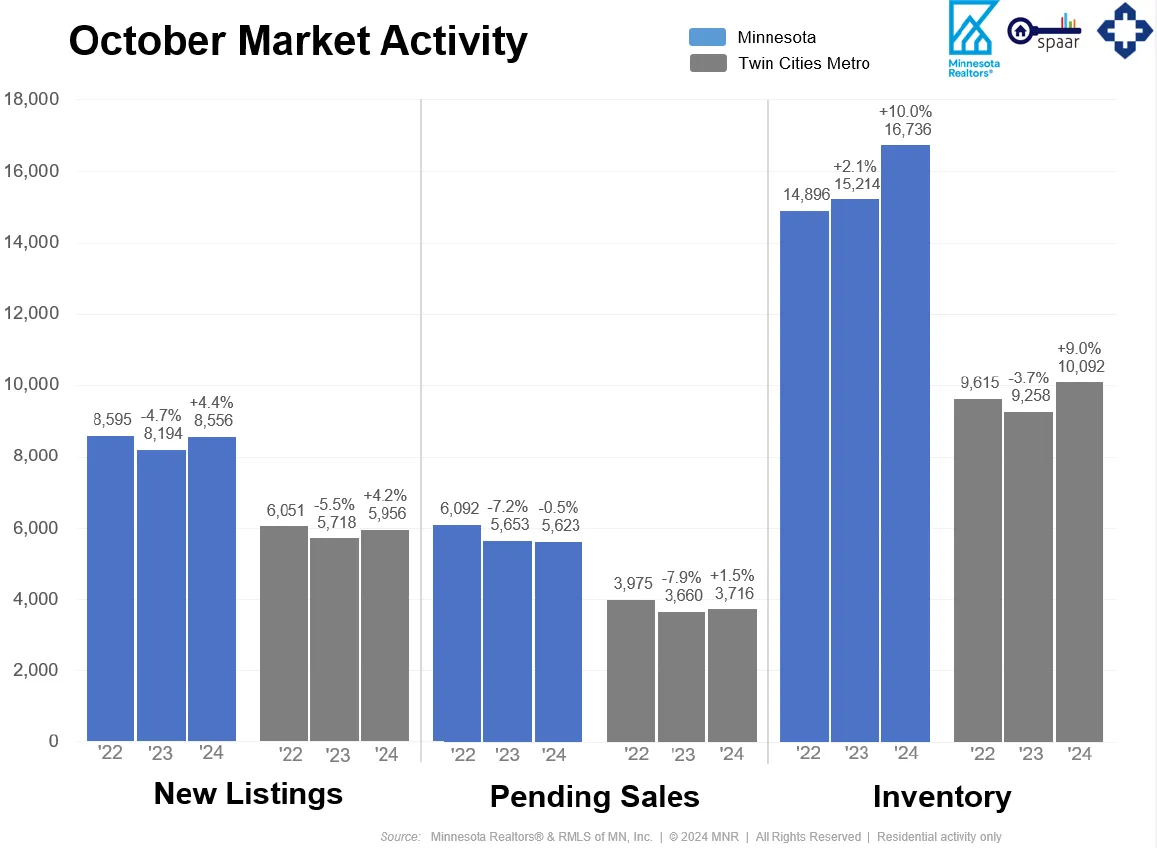

- Signed purchase agreements were up 10.4% statewide, and new listings were up 9.1%

- The median sales price increased 5.3% to $347,500

- Market times rose 10.5% to 42 days, and inventory was up 8.2% to 16,281

(Nov. 14, 2024) – According to new data from the Minnesota state and Twin Cities metro REALTOR® Associations, listings, sales, prices and inventory all rose in October.

Sellers, Buyers and Housing Supply

Mortgage rates hovered between 6.0–7.0% all month long, but buyers seem to be adjusting to the current rate environment as pending sales rose a strong 10.4% statewide and 14.3% in the metro. The average 30-year mortgage rate was 6.18% in September and 6.43% in October. With the exception of September, rates haven’t been that low since May of 2023. The pent-up activity is on the supply side, too. Most sellers are also buyers, and those who chose to delay their move are getting restless. While they’ll be met with more inventory, they may not see the most ideal interest rate. Still, new listings were up 9.1% statewide and 8.7% in the metro compared to last October.

Despite recent gains, supply levels remain low due to a lack of new home construction. Existing sellers who would ordinarily move up the housing ladder and free up their first-time home feel “locked in” to their favorable mortgage rates. Those rates are often between 3.0–4.0% or lower compared to nearly 7.0% today. The Federal Housing Finance Agency (FHFA) has found that about 70% of all outstanding mortgages are financed below 4.0%. There are signs of change, but housing demand has fallen due to the affordability crisis. The persistent housing shortage kept home prices rising, just as the Federal Reserve hiked interest rates to combat inflation. Prospective home buyers are still feeling the triple punch of higher prices, higher mortgage rates, and limited inventory. While home prices are still rising, wage growth has been exceeding the rate of inflation. In fact, the U.S. Bureau of Labor Statistics reports that wages are rising at 4.6% while inflation is rising at 2.4%.

“We see buyers adjusting to today’s mortgage rates, but experienced Realtors know there are many ways to get deals done,” said Geri Theis, President of Minnesota Realtors®. “Having a strong Realtor negotiating on your behalf, directing you to down payment resources and offering suggestions on timelines and contingencies will help you stand out against your competition and ultimately help you close the deal.”

Prices, Market Times and Negotiations

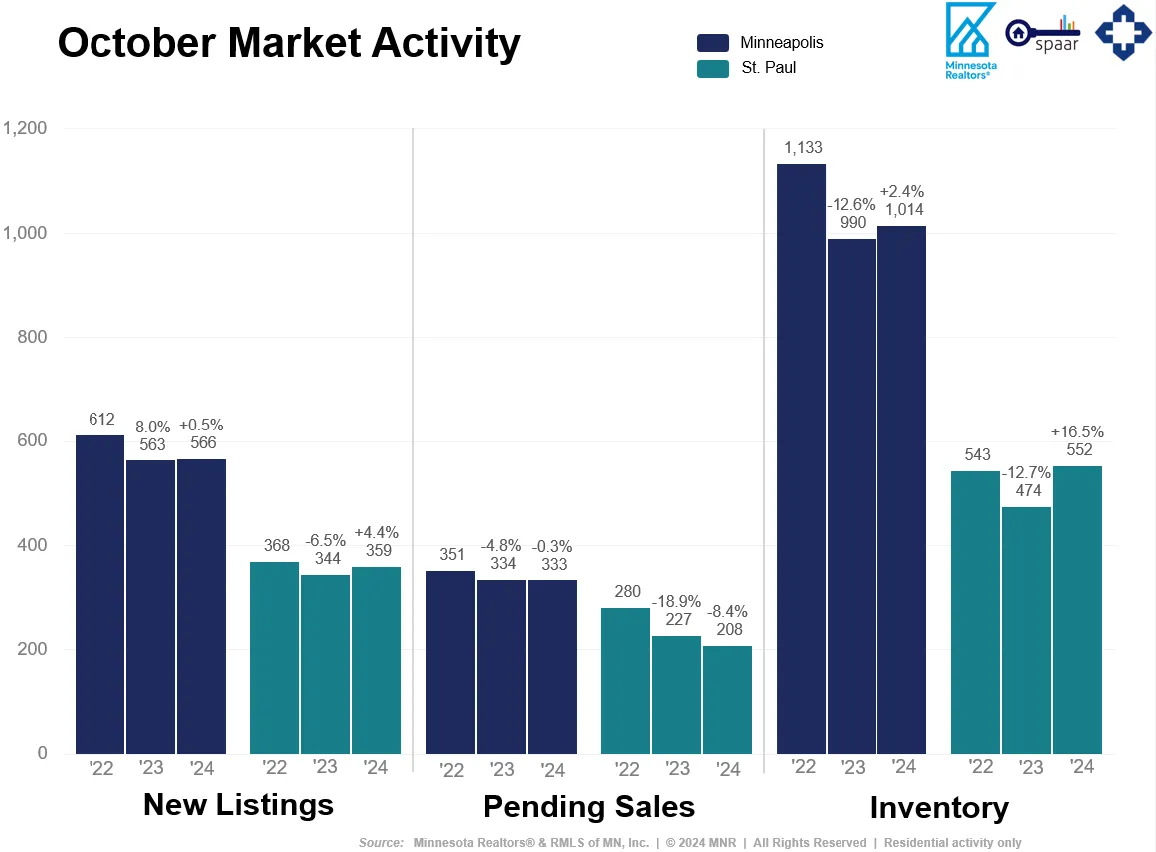

Every area and market segment is unique. Some listings are getting multiple offers and closing for over list price. But overall, sellers accepted offers at 97.1% of list price statewide and 97.8% in the metro—both down from last year. And those offers were accepted after an average of 42 days on market statewide and 45 days in the metro—both figures up from a year ago. “We’re seeing different activity in different price points, areas and segments such as condos or new construction,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “What’s impacting $1M+ buyers isn’t necessarily on the mind of a $300,000 buyer, and condos and new construction are better supplied and more accessible than the existing single-family market, for example.”

The state median home price was up 5.3% to $347,500, and the metro median price was up 4.1% to $380,000. A slowdown in price growth would give incomes a chance to catch up, helping address affordability concerns. And additional inventory will mean less upward price pressure from a persistent supply shortage. It would also allow buyers to have more options from which to choose. “Sales numbers confirm some of the renewed optimism I’m seeing in today’s housing market given better rates and more inventory,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “While many sellers and buyers feel now is the right time to make a move, it’s still important to consider their goals in taking that next step and negotiating offers.”

Locational Differences | Minnesota statewide

Market activity always varies by area, price point and property type. Regions such as Duluth and the North Shore and Hibbing/Virginia saw the largest gains in seller activity. Alexandria, St. Cloud and the Twin Cities had the largest gains in pending sales. Homes sold the fastest in the Duluth/North Shore region along with St. Cloud. Prices were highest in the metro followed by Detroit Lakes and Rochester. The most affordable regions of the state were Hibbing/Virginia and Willmar. Every region is undersupplied except Hibbing/Virginia, Detroit Lakes and Bemidji, which are relatively well balanced.

Locational Differences | Twin Cities Metro

For cities with at least five sales, Afton, Columbus and Arden Hills had the largest sales gains. The highest priced areas were Orono, Afton and North Oaks while the most affordable areas were South St. Paul, Brooklyn Center and Isanti. But the largest increases in sales price were in Afton, Orono and Hopkins. The most oversupplied markets were Clear Lake, Centerville and Cokato while the most undersupplied markets were Oak Park Heights, North St. Paul and Mound. Homes took the longest to sell in Mayer, Columbus and Centerville and sold the fastest in Norwood, Greenfield and New Brighton.

From The Skinny Blog.

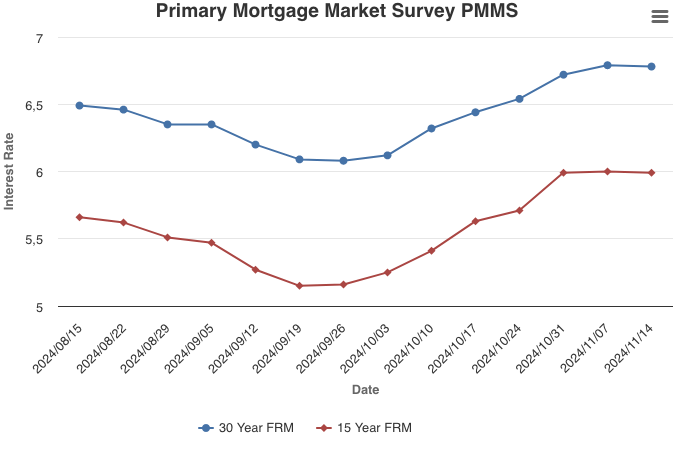

Following Elections Results and a Fed Rate Cut, Mortgage Rates Stall

November 14, 2024

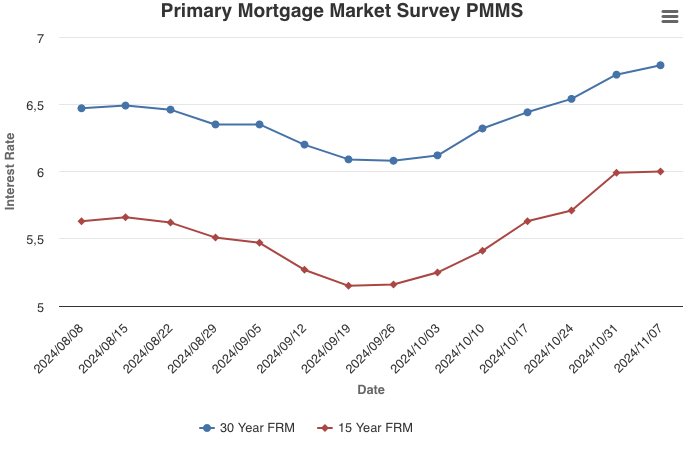

After a six-week climb, rates have leveled off, but overall affordability continues to be an issue for potential homebuyers. Freddie Mac’s latest research shows that mortgage payments compared to rents on the same homes are elevated relative to most of the last three decades.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 2, 2024

For Week Ending November 2, 2024

U.S. housing starts edged down 0.5% from the previous month to a seasonally adjusted annual rate of 1.35 million units, according to the U.S. Census Bureau. Single-family housing starts rose 2.7% to a seasonally adjusted annual rate of 1.03 million units, a five-month high, while multi-family housing starts declined 4.5% to 317,000 units. Year to date, single-family construction is up 10.1%.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 2:

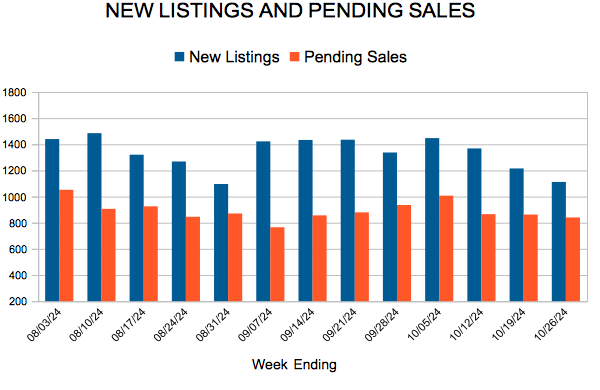

- New Listings decreased 3.1% to 1,035

- Pending Sales increased 7.8% to 839

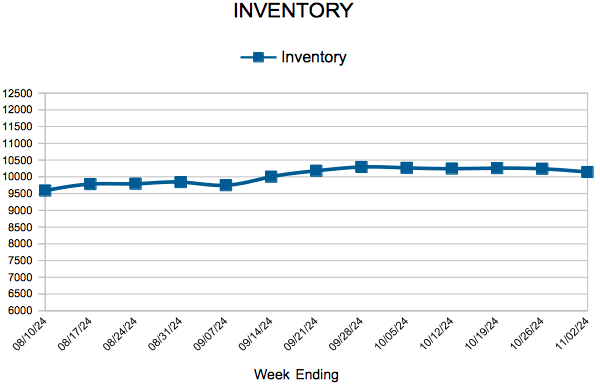

- Inventory increased 9.7% to 10,144

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $379,950

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Rise

November 7, 2024

Mortgage rates continued to inch up this week, reaching 6.79 percent. It is clear purchase demand is very sensitive to mortgage rates in the current market environment. As soon as rates began to rise in early October, purchase applications fell and over the last month have declined 10 percent.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 110

- Next Page »