For Week Ending April 3, 2021

For Week Ending April 3, 2021

The University of Michigan’s latest Consumer Sentiment Index came in at 84.9 points, up from 76.8 in February and the highest level since last March’s 89.1 reading. The index is an economic indicator of the overall health of the economy as determined by consumer opinion. Increasing values point to increasing consumer confidence in their own financial health and the health of the overall economy.

In the Twin Cities region, for the week ending April 3:

- New Listings decreased 7.6% to 1,406

- Pending Sales increased 21.8% to 1,358

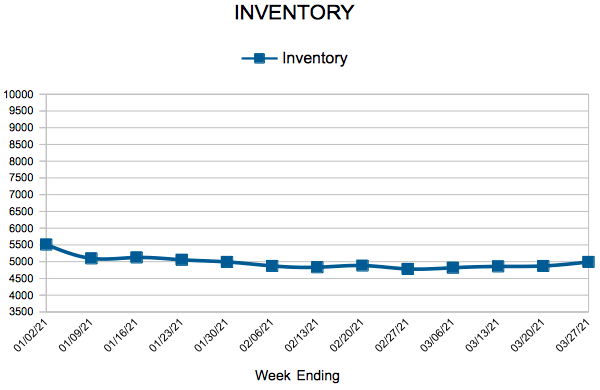

- Inventory decreased 49.4% to 5,051

For the month of February:

- Median Sales Price increased 11.5% to $314,000

- Days on Market decreased 31.3% to 46

- Percent of Original List Price Received increased 2.1% to 100.1%

- Months Supply of Homes For Sale decreased 47.1% to 0.9

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.