Weekly Market Report

For Week Ending September 24, 2022

For Week Ending September 24, 2022

Lumber prices plunged to their lowest level in more than two years following the Federal Reserve’s 75-basis-point rate hike last week, as soaring mortgage interest rates and the slowdown in the US housing market have caused lumber demand to cool rapidly this year. The Wall Street Journal reports lumber futures are down about one-third from a year ago and have fallen more than 70% from this year’s peak in March.

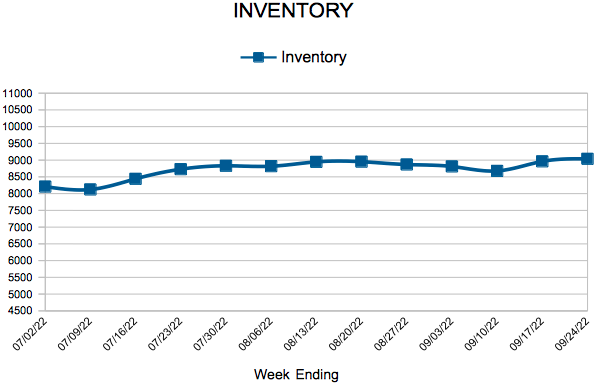

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 24:

- New Listings decreased 20.2% to 1,273

- Pending Sales decreased 29.4% to 983

- Inventory increased 0.4% to 9,039

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 17, 2022

For Week Ending September 17, 2022

Mortgage rates topped 6% the week ending 9/15, as hotter-than-expected inflation helped push rates to their highest level since 2008 amid growing recession concerns. According to Freddie Mac, mortgage rates are now double what they were this time last year, squeezing homebuyer budgets and causing home sales to slow under the weight of rising borrowing costs.

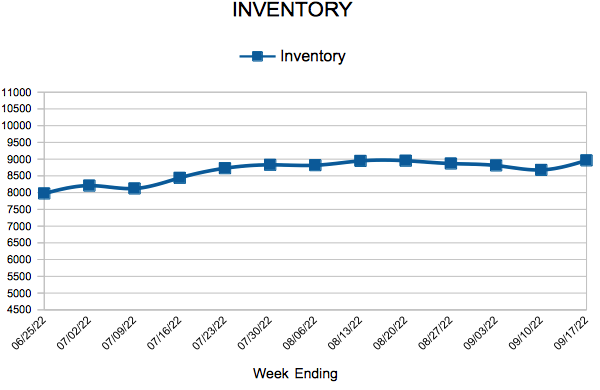

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 17:

- New Listings decreased 20.5% to 1,424

- Pending Sales decreased 31.3% to 908

- Inventory increased 1.3% to 8,962

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Inventory

Weekly Market Report

For Week Ending August 20, 2022

For Week Ending August 20, 2022

Rents continue to soar to new highs amid low vacancy rates, with the median rent hitting $1,879 in the 50 largest U.S. metropolitan areas in July, a 12.3% increase from the same time last year, according to a recent report from Realtor.com. Although rents remain elevated, rent growth appears to be slowing, having increased only $3 from June to July, with tenants in urban areas typically seeing higher rent hikes compared to those in the suburbs.

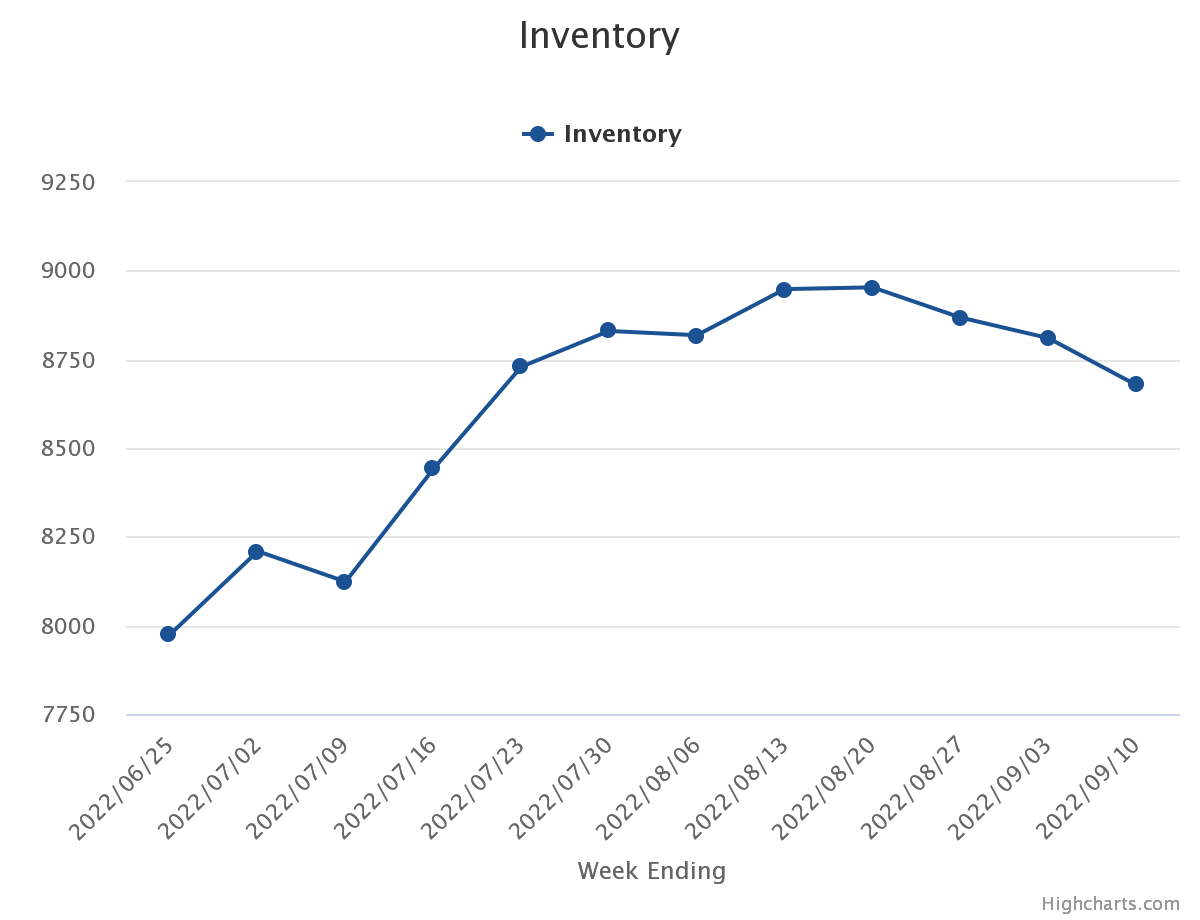

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 20:

- New Listings decreased 27.3% to 1,326

- Pending Sales decreased 23.5% to 1,138

- Inventory increased 5.1% to 8,953

FOR THE MONTH OF JULY:

- Median Sales Price increased 7.1% to $375,000

- Days on Market increased 15.8% to 22

- Percent of Original List Price Received decreased 2.0% to 101.5%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 13, 2022

For Week Ending August 13, 2022

After declining for three consecutive quarters, the share of homebuyers actively searching for a home grew to 49% nationally in the second quarter of 2022, up from 46% the previous quarter, according to the National Association of Home Builders (NAHB) recent Housing Trends Report. NAHB economists credit the rise in buyer activity to a less competitive housing market, which has motivated more prospective buyers to advance from the planning stage of the homebuying process to actively trying to purchase a home.

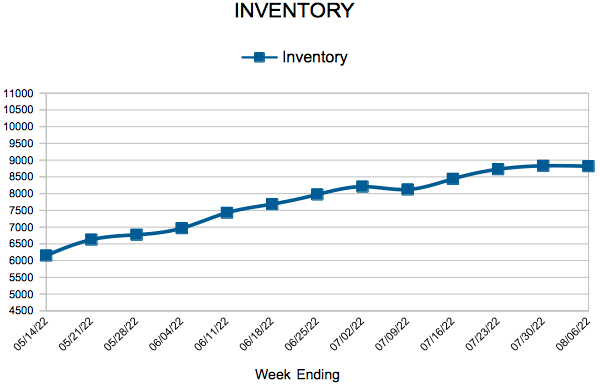

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 13:

- New Listings decreased 16.0% to 1,480

- Pending Sales decreased 22.6% to 1,173

- Inventory increased 5.4% to 8,948

FOR THE MONTH OF JULY:

- Median Sales Price increased 7.1% to $375,000

- Days on Market increased 15.8% to 22

- Percent of Original List Price Received decreased 2.0% to 101.5%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

- « Previous Page

- 1

- …

- 15

- 16

- 17

- 18

- 19

- …

- 40

- Next Page »