- Median sales price of Twin Cities homes rose 0.6 percent to just under $342,000

- Buyer activity down 23.6 percent with 2,932 pending sales

- Sellers listed 24.3 percent fewer homes compared to last February

(March 15, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the median sales price across the Twin Cities grew 0.6 percent to $342,000. Home price growth has flattened out in the face of higher mortgage rates and deteriorating affordability.

Inventory & Home Prices

Although home prices have flattened out, they were still up slightly year-over-year. It’s possible that home prices soften in the coming months if rates rise further or remain sticky. “People should understand that their home hasn’t necessarily lost value simply because the median price falls,” according to Jerry Moscowitz, President of Minneapolis Area REALTORS®. “The median reflects the mid-point where half the homes sell for more and half for less. If there are more luxury properties, new homes or condos selling, that all impacts prices. So does supply and demand.”

Home buyers have been able to purchase bigger, nicer homes when rates were low because the payment allowed them to. That’s changed. Buyers are more willing to look at other property types, smaller homes and in different areas. That doesn’t mean every home out there is worth any less, but likely means those that do sell may have to be flexible and make some concessions.

Given the pullback in sales, we had 7.1 percent more homes on the market at month-end. Before buyers celebrate more options, the metro only has 1.3 month’s supply of inventory. Typically 4-6 months of supply are needed to reach a balanced market. Since both sales and listings have come down in tandem, the market remains fairly thin. That said, sellers don’t quite have the leverage they’ve enjoyed of late.

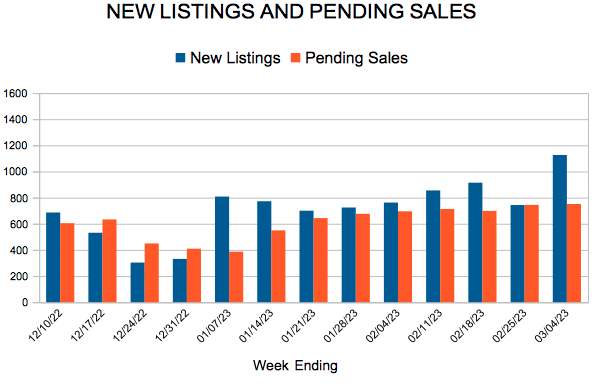

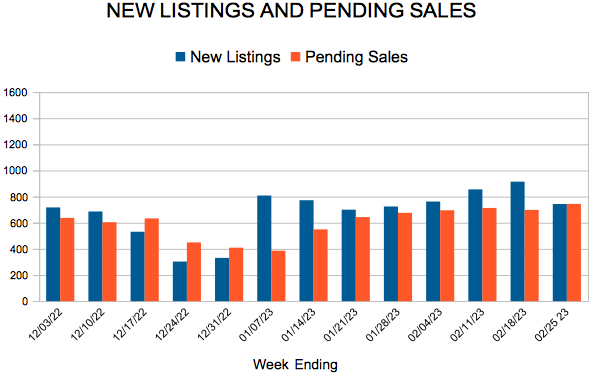

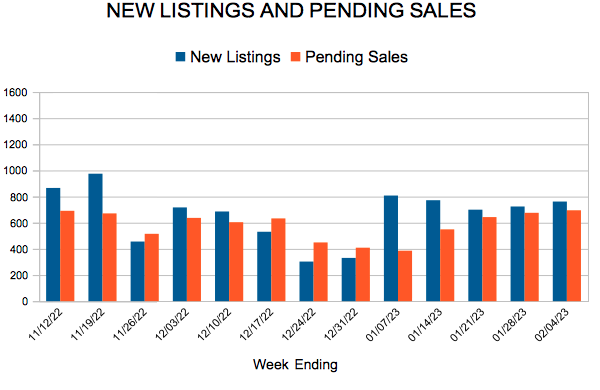

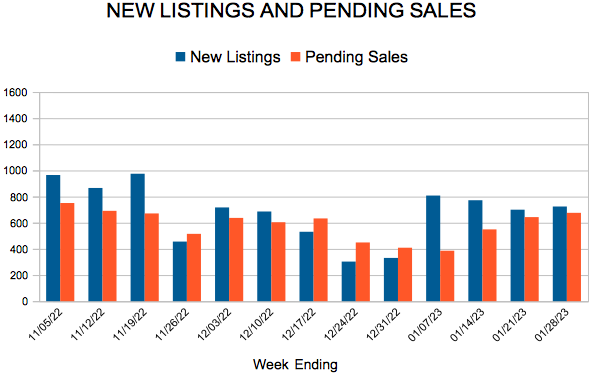

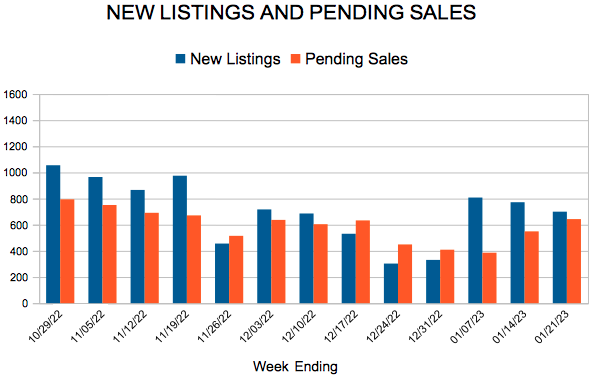

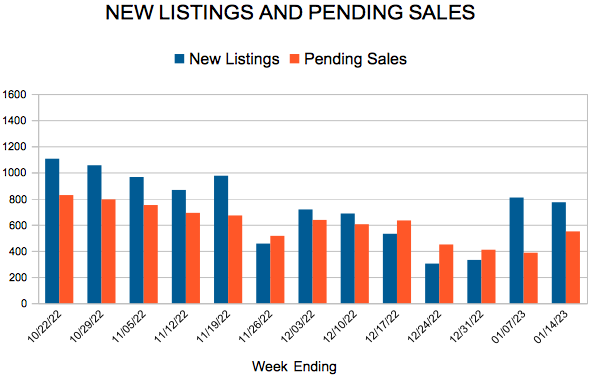

Sales & Listings

The Federal Reserve’s rate hikes have taken a toll on home sales. As some buyers were sidelined by higher mortgage rates and increased monthly payments, resulting in 2,932 purchase agreements, 23.6 percent below last year. The decline in pending sales is the second smallest since July 2022—behind January of this year and hinting that perhaps the declines are easing. “We’re in a place where buyers have more leverage but lowball offers likely won’t be successful,” said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “That means buyers are writing offers at or slightly below list price and they can take more time to decide on what works best for them.”

Sellers brought 3,423 homes on the market in February, 24.3 percent fewer listings than last year. Half of all sellers sold their listings for over 98.2 percent of list price compared to 100.0 percent last year. And they accepted those offers after an average of 62 days on market compared to 44 last year.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 9.2 percent while existing home sales were down 25.7 percent. Single family sales fell 26.2 percent, condo sales declined 36.0 percent and townhome sales were down 6.4 percent. Sales in Minneapolis decreased 35.0 percent while Saint Paul sales fell 33.7 percent. Cities like Corcoran, Buffalo, Watertown and St. Francis saw the largest sales gains while Hudson, Forest Lake and Carver all had notably lower demand than last year.

February 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 3,423 properties on the market, a 24.3 percent decrease from last February

- Buyers signed 2,932 purchase agreements, down 23.6 percent (2,295 closed sales, down 20.3 percent)

- Inventory levels grew 7.1 percent to 5,327 units

- Month’s Supply of Inventory rose 44.4 percent to 1.3 months (4-6 months is balanced)

- The Median Sales Price rose 0.6 percent to $342,000

- Days on Market rose 40.9 percent to 62 days, on average (median of 44 days, up 131.6 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 26.2 percent; Condo sales were down 36.0 percent & townhouse sales fell 6.4 percent

- Traditional sales declined 23.9 percent; foreclosure sales rose 10.3 percent; short sales increased by 8 units

- Previously owned sales decreased 25.7 percent; new construction sales declined 9.2 percent