May 19, 2022

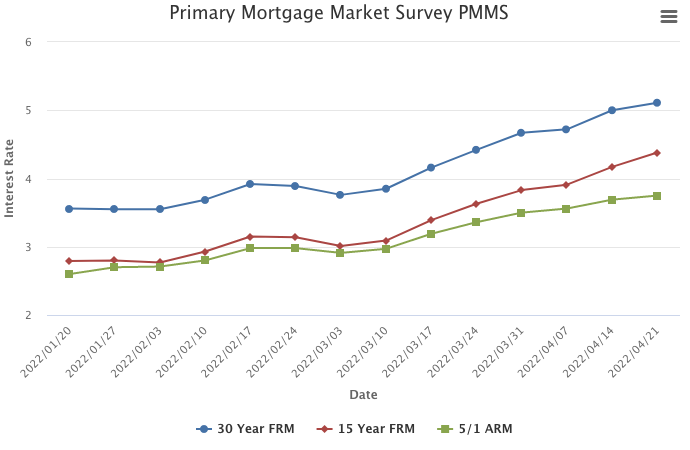

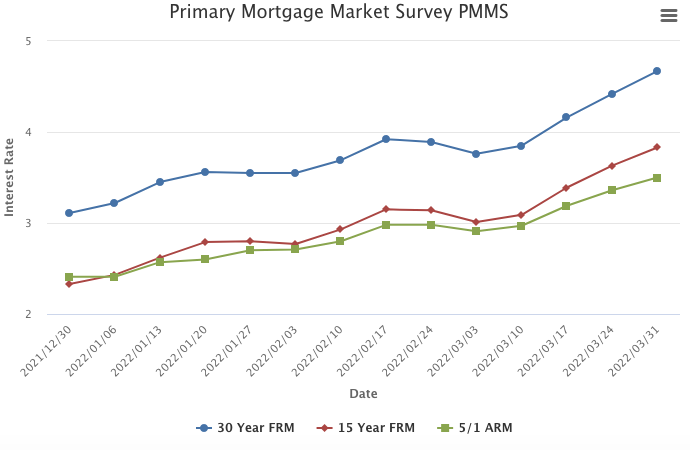

Economic uncertainty is causing mortgage rate volatility. As a result, purchase demand is waning, and homebuilder sentiment has dropped to the lowest level in nearly two years. Builders are also dealing with rising costs, meaning this posture is likely to continue.

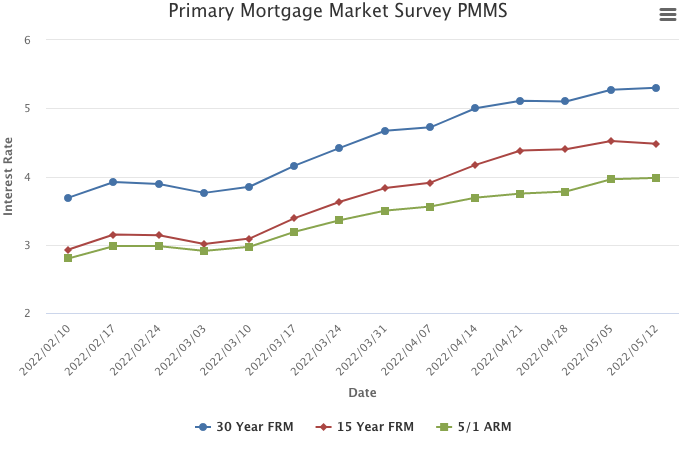

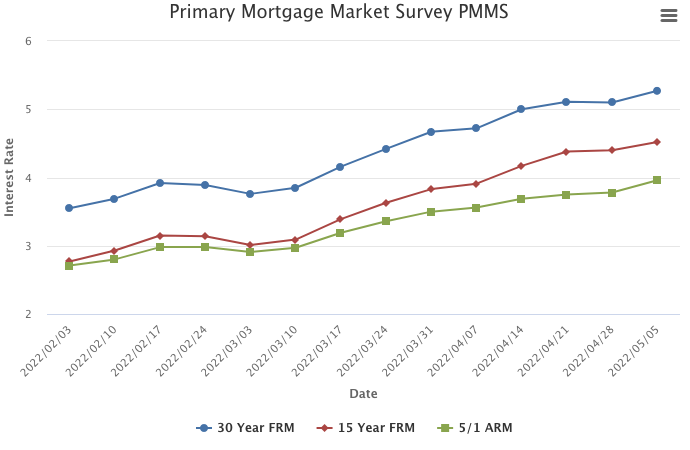

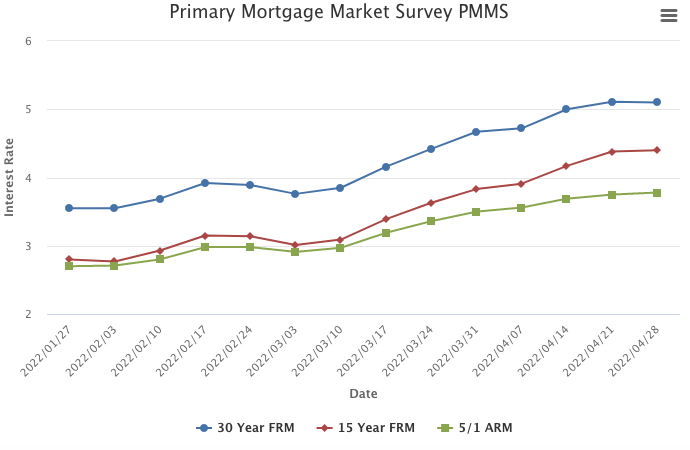

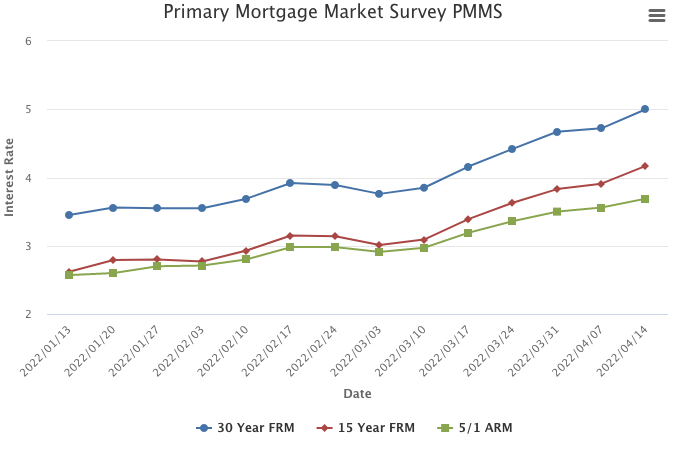

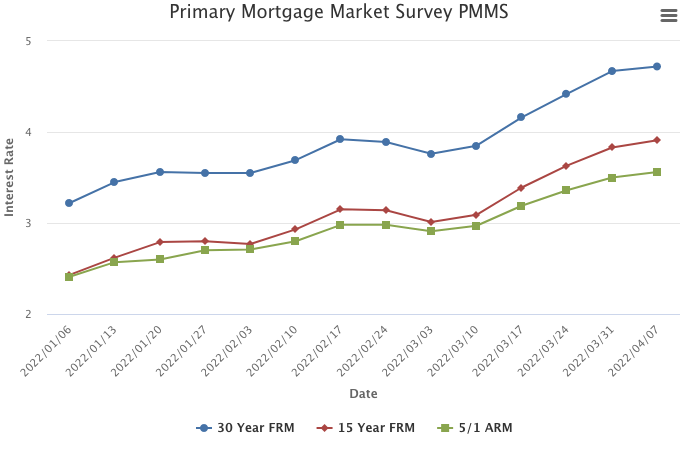

Information provided by Freddie Mac.