December 28, 2023

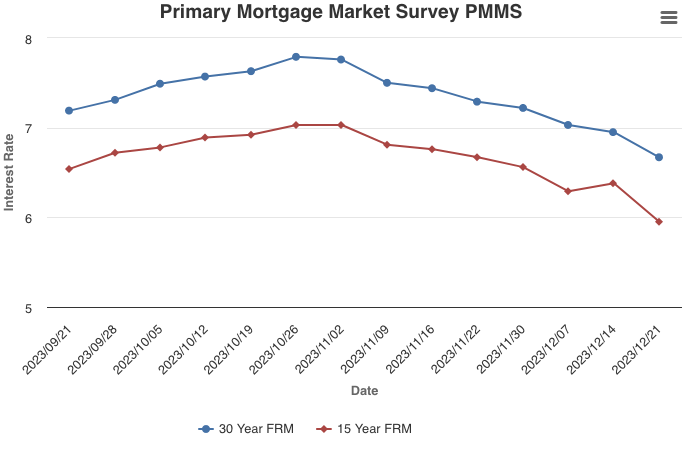

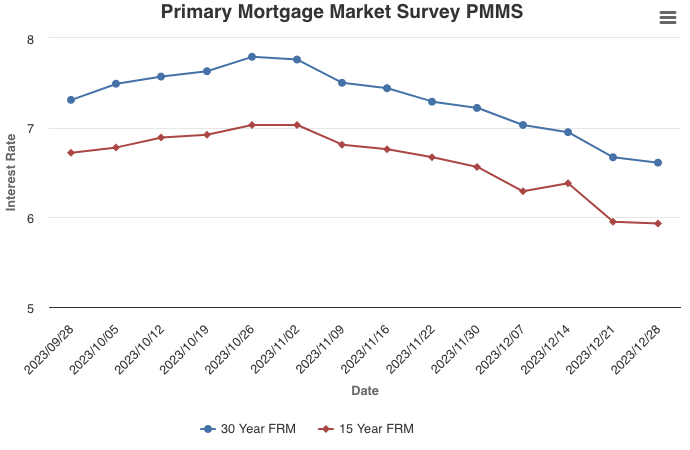

The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down. Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market.

Information provided by Freddie Mac.

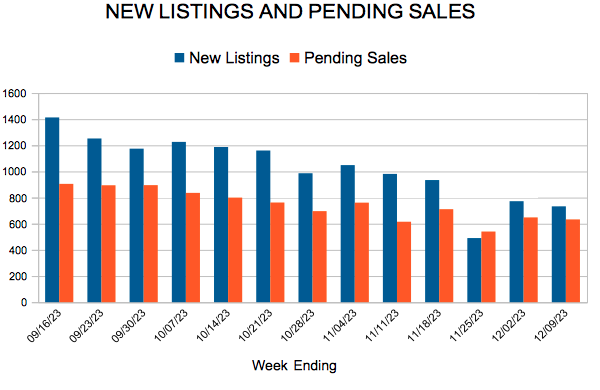

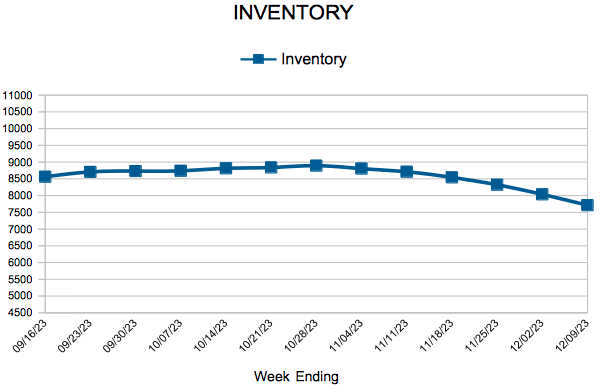

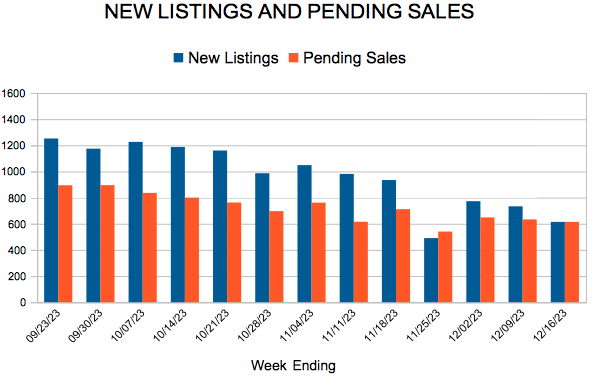

For Week Ending December 16, 2023

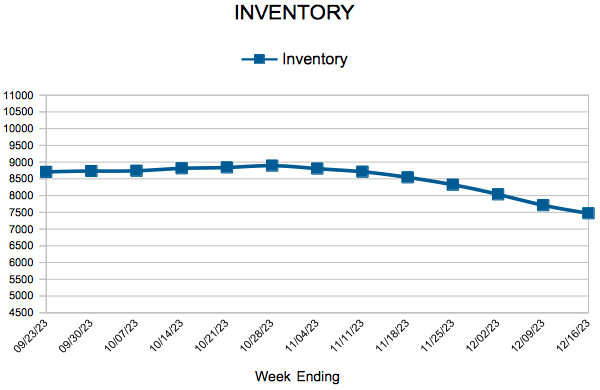

For Week Ending December 16, 2023