May 4, 2023

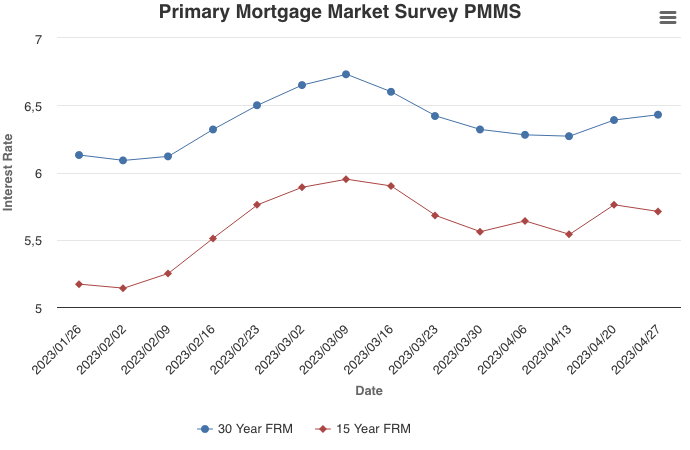

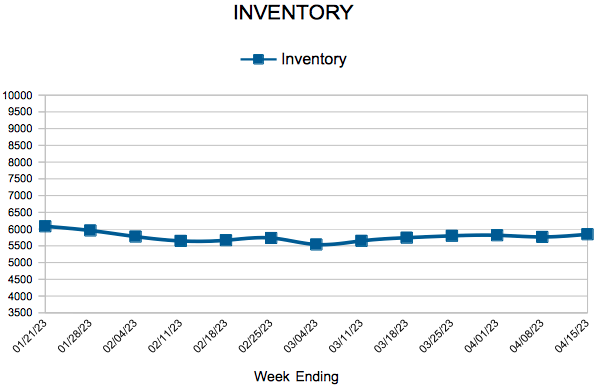

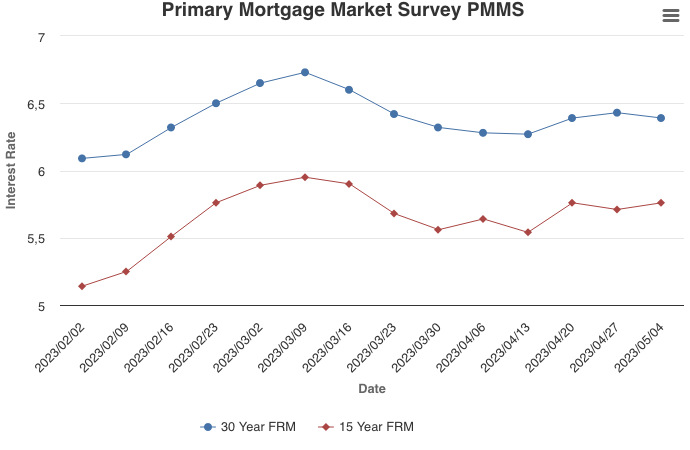

This week, mortgage rates inched down slightly amid recent volatility in the banking sector and commentary from the Federal Reserve on its policy outlook. Spring is typically the busiest season for the residential housing market and, despite rates hovering in the mid-six percent range, this year is no different. Interested homebuyers are acclimating to the current rate environment, but the lack of inventory remains a primary obstacle to affordability.

Information provided by Freddie Mac.

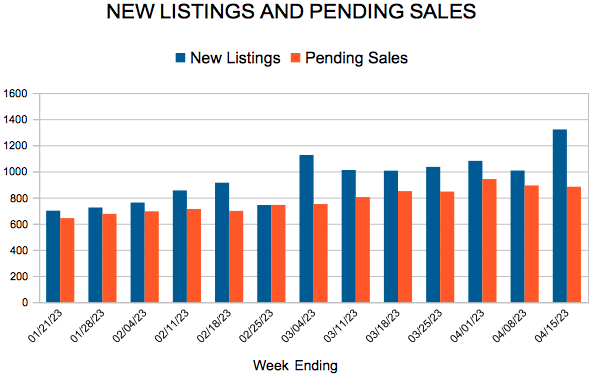

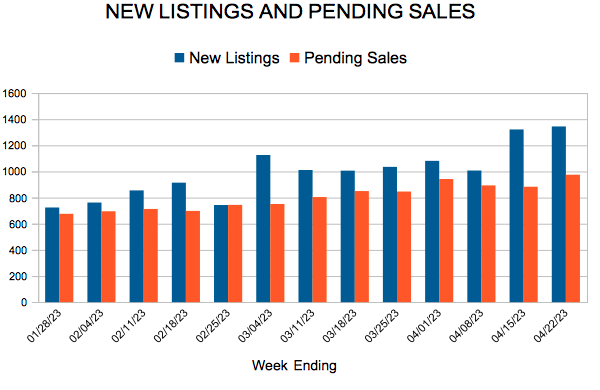

For Week Ending April 22, 2023

For Week Ending April 22, 2023