Weekly Market Report

For Week Ending October 28, 2023

For Week Ending October 28, 2023

Elevated mortgage rates have surpassed high home prices as the primary barrier to housing affordability, according to Fannie Mae’s latest Home Price Sentiment Index (HPSI), which fell by 2.4 points to 64.5 in September. The monthly decrease in HPSI was attributed to net decreases in 5 of the Index’s 6 components—Buying Conditions, Selling Conditions, Mortgage Rate Outlook, Job Loss Concern, and Change in Household Income—with the majority of consumers reporting that they expect mortgage rates will continue to rise over the next 12 months.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 28:

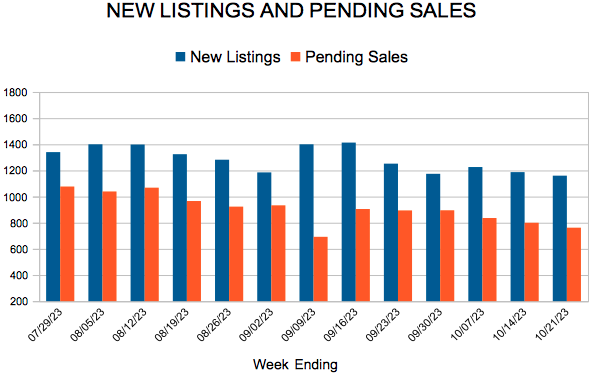

- New Listings decreased 9.1% to 986

- Pending Sales decreased 13.2% to 696

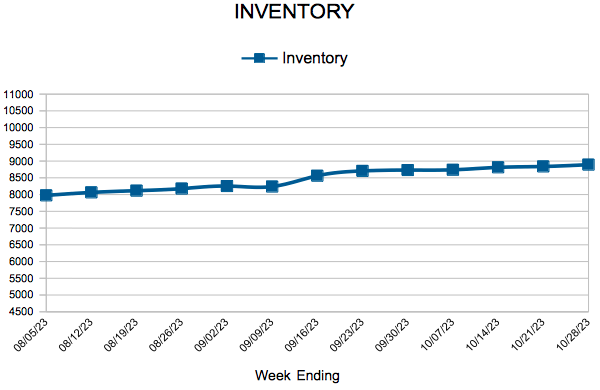

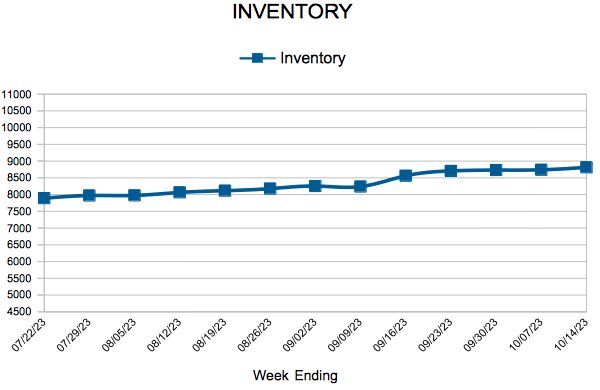

- Inventory decreased 6.3% to 8,893

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

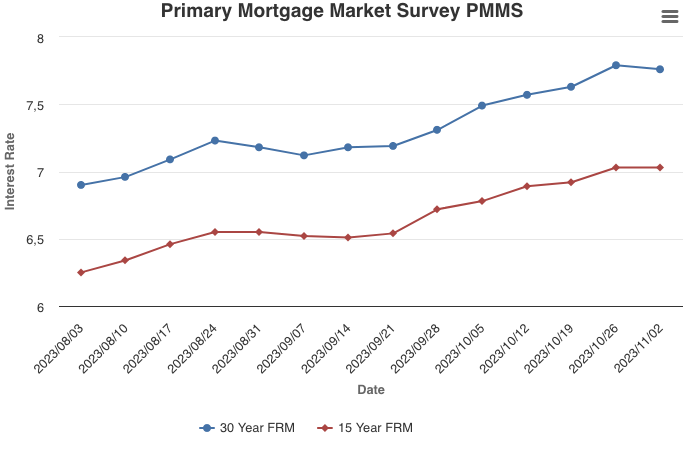

After a Multi-week Climb, Mortgage Rates Level Off

November 2, 2023

The 30-year fixed-rate mortgage paused its multi-week climb but continues to hover under eight percent. The Federal Reserve again decided not to raise interest rates but have not ruled out a hike before year-end. Coupled with geopolitical uncertainty, this ambiguity around monetary policy will likely have an impact on the overall economic landscape and may continue to stall improvements in the housing market.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 21, 2023

For Week Ending October 21, 2023

Annual U.S. single-family rent growth fell to 2.9% in August, marking the 16th consecutive month of declines, according to Corelogic’s most recent Single-Family Rent Index (SFRI). Although rent growth continues to moderate, single-family rents have increased by 30% nationwide since February 2020 and renters are feeling the effects, with the average American renter household spending about 40% of its income on housing costs as of last measure.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 21:

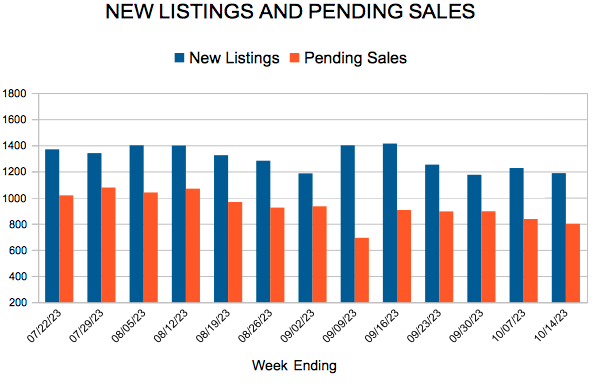

- New Listings increased 3.2% to 1,160

- Pending Sales decreased 10.8% to 762

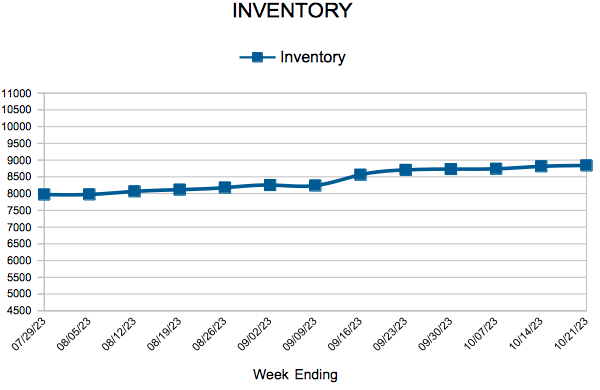

- Inventory decreased 7.5% to 8,839

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

September Monthly Skinny Video

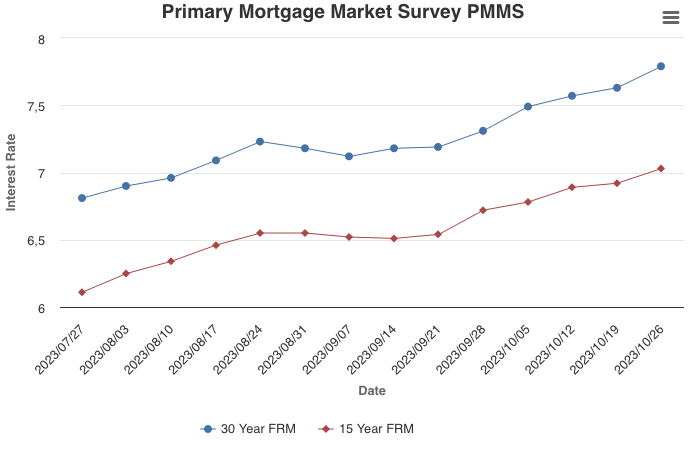

Mortgage Rates Continue to Climb Toward Eight Percent

October 26, 2023

For the seventh week in a row, mortgage rates continued to climb toward eight percent, resulting in the longest consecutive rise since the Spring of 2022. Rates have risen two full percentage points in 2023 alone and, as we head into Halloween, the impacts may scare potential homebuyers. Purchase activity has slowed to a virtual standstill, affordability remains a significant hurdle for many and the only way to address it is lower rates and greater inventory.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 45

- 46

- 47

- 48

- 49

- …

- 119

- Next Page »