For Week Ending January 29, 2022

For Week Ending January 29, 2022

Home seller profits increased in more than 90% of housing markets last year, the highest level since 2008, according to ATTOM Data Solutions’ Year-End 2021 U.S. Home Sales Report. On average, sellers saw a profit of $94,092 on a typical median-priced home in 2021, an increase of 45% from 2020 and up 71% from 2019. Sellers saw a 45.3% return on investment compared to the original purchase price, with the highest profits found among sellers in western states.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 29:

- New Listings decreased 17.8% to 850

- Pending Sales decreased 12.8% to 826

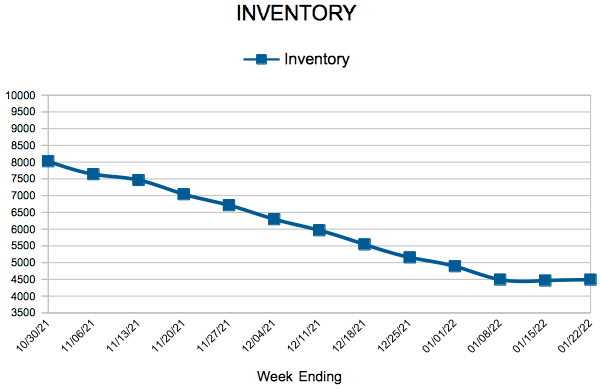

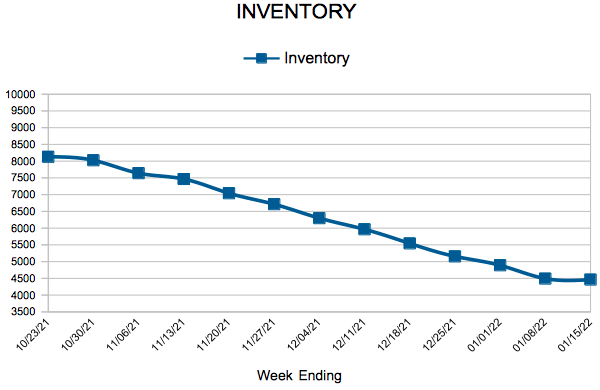

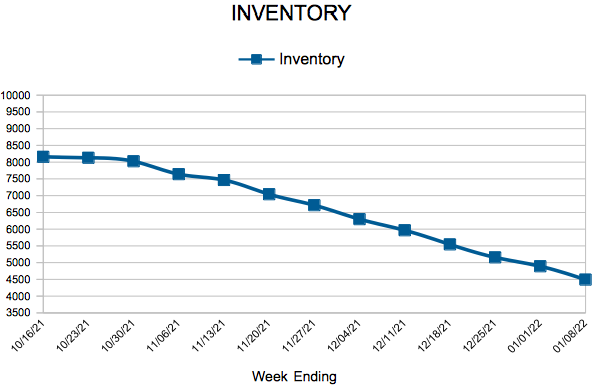

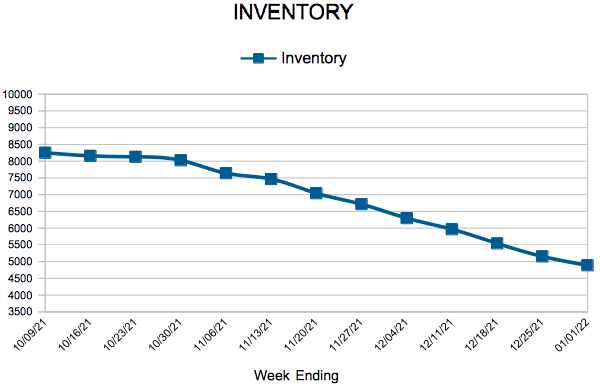

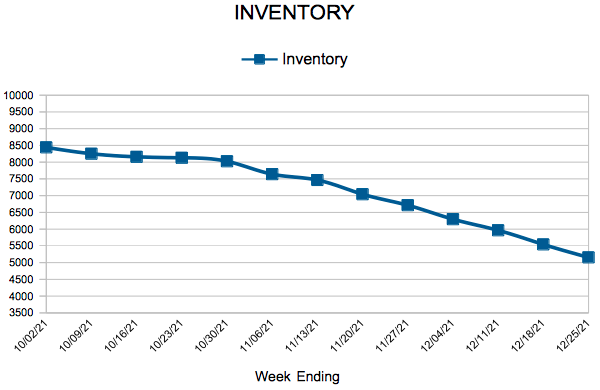

- Inventory decreased 21.2% to 4,432

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 7.9% to $331,270

- Days on Market decreased 12.8% to 34

- Percent of Original List Price Received decreased 0.2% to 99.5%

- Months Supply of Homes For Sale decreased 18.2% to 0.9

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.