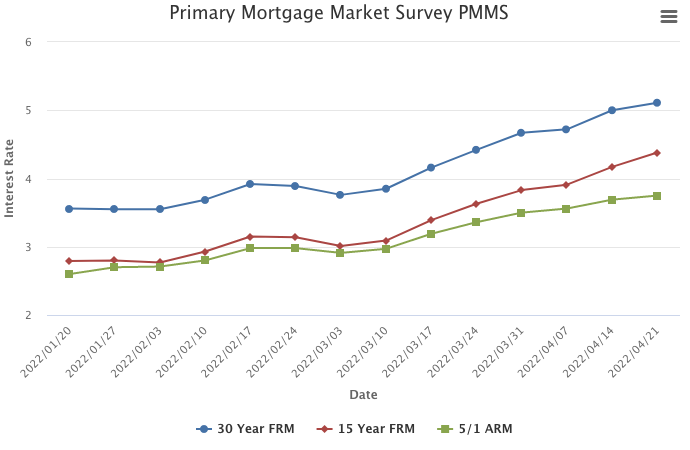

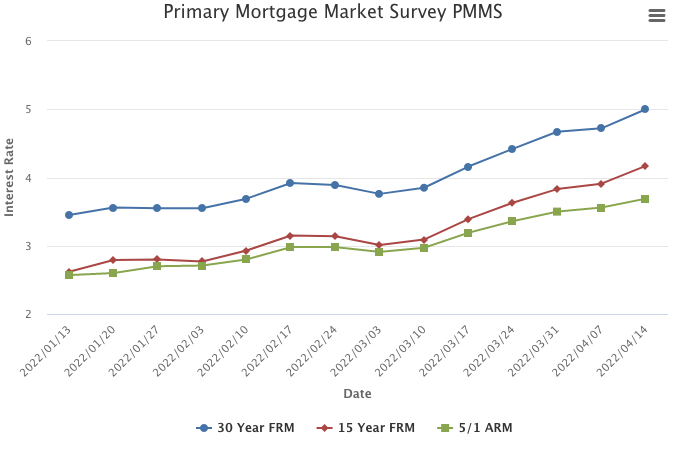

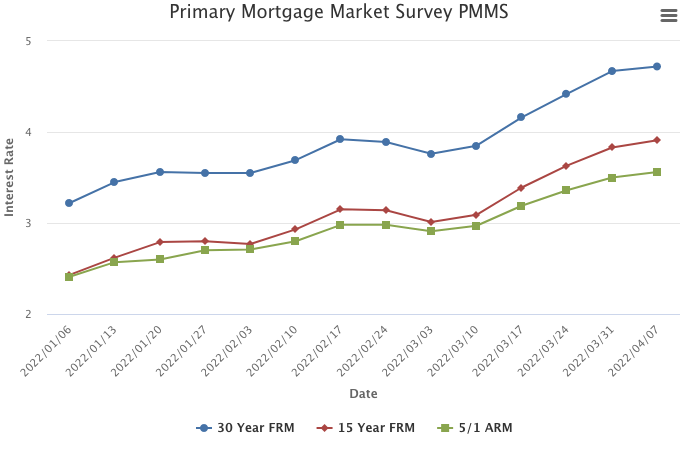

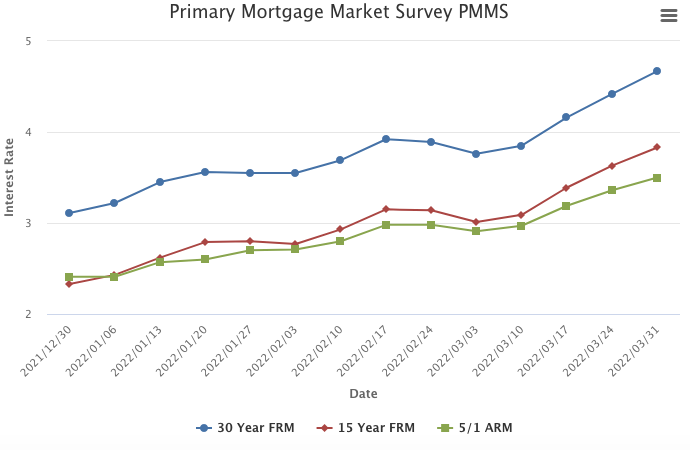

April 28, 2022

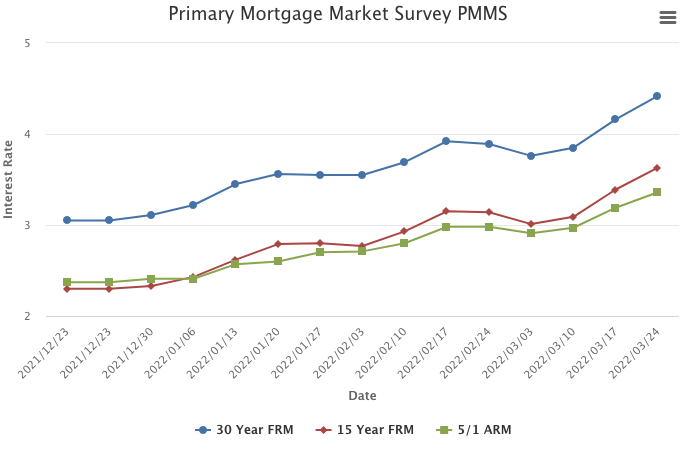

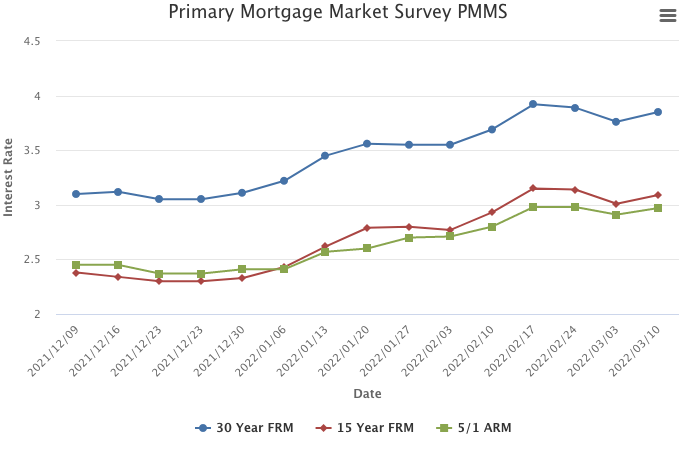

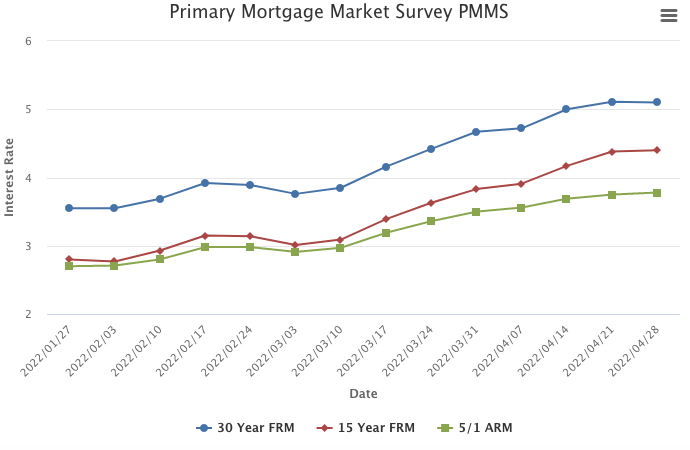

The combination of swift home price growth and the fastest mortgage rate increase in over forty years is finally affecting purchase demand. homebuyers navigating the current environment are coping in a variety of ways, including switching to adjustable-rate mortgages, moving away from expensive coastal cities, and looking to more affordable suburbs. We expect the decline in demand to soften home price growth to a more sustainable pace later this year.

Information provided by Freddie Mac.