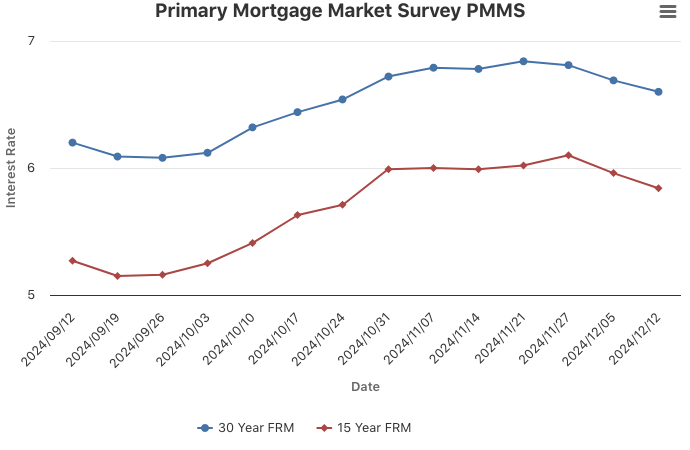

Heading into the Holidays, Mortgage Rates Increase

December 19, 2024

This week, mortgage rates crept up to a similar average as this time in 2023. For the most part, mortgage rates have moved between 6 and 7 percent over the last 12 months. Homebuyers are slowly digesting these higher rates and are gradually willing to move forward with buying a home, resulting in additional purchase activity.

Information provided by Freddie Mac.

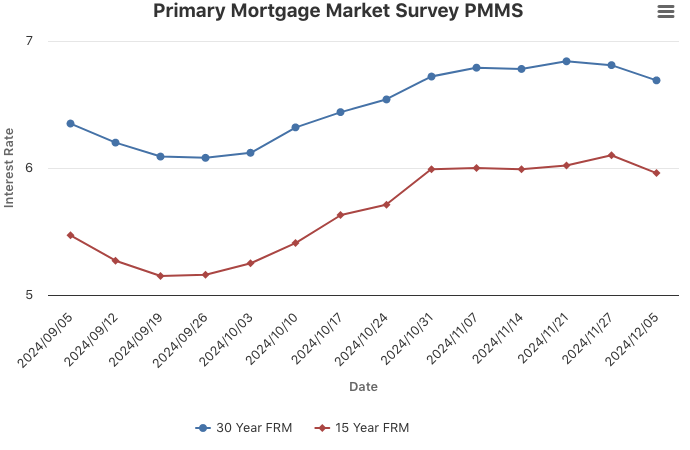

Mortgage Rates Continue to Drop

December 12, 2024

The 30-year fixed-rate mortgage decreased for the third consecutive week. The combination of mortgage rate declines, firm consumer income growth and a bullish stock market have increased homebuyer demand in recent weeks. While the outlook for the housing market is improving, the improvement is limited given that homebuyers continue to face stiff affordability headwinds.

Information provided by Freddie Mac.

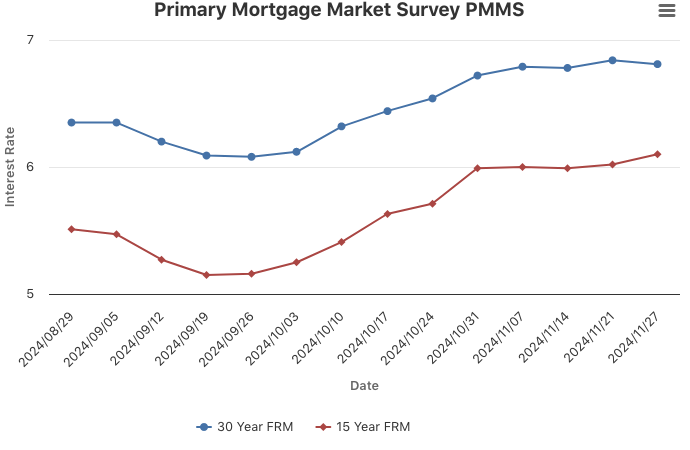

Mortgage Rates Continue to Decrease

December 5, 2024

This week, mortgage rates decreased to their lowest level in over a month. Despite just a modest drop in rates, consumers clearly have responded as purchase demand has noticeably improved. The responsiveness of prospective homebuyers to even small changes in rates illustrates that affordability headwinds persist.

Information provided by Freddie Mac.

The 30-Year Fixed-Rate Mortgage Inches Down

November 27, 2024

The 30-year fixed-rate mortgage moved down this week, but not by much. Rates have been relatively flat over the last few weeks as the market waits for more clarity on specific economic policies. Potential homebuyers are also waiting on the sidelines, causing demand to be lackluster. Despite the low sales activity, inventory has only modestly improved and remains dramatically undersupplied.

Information provided by Freddie Mac.

October Monthly Skinny Video

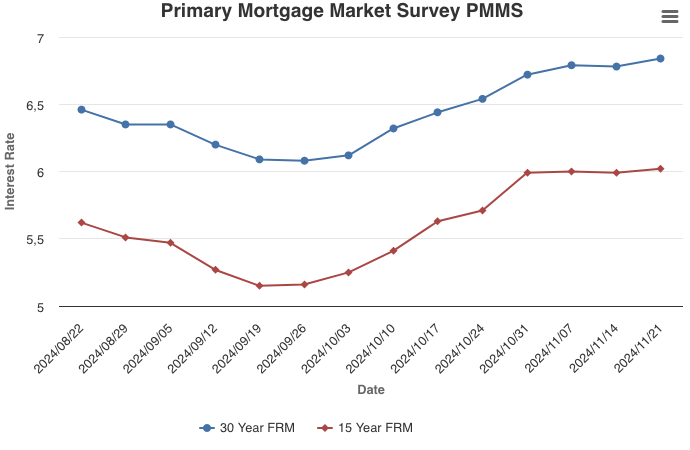

Mortgage Rates Tick Up

November 21, 2024

Mortgage rates ticked back up this week, continuing to approach 7 percent. Heading into the holidays, purchase demand remains in the doldrums. While for-sale inventory is increasing modestly, the elevated interest rate environment has caused new construction to soften.

Information provided by Freddie Mac.

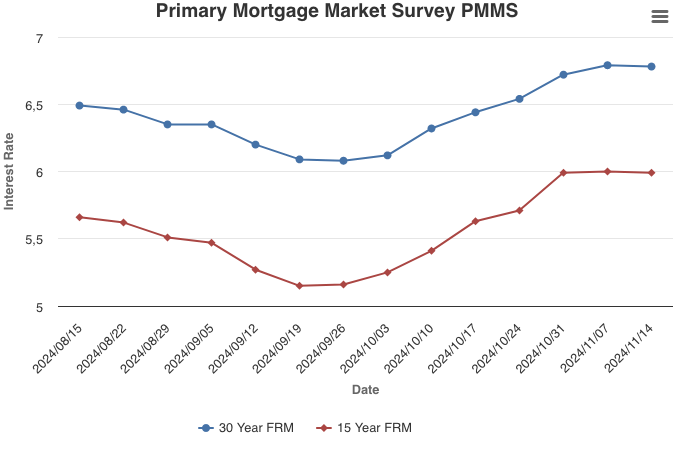

Following Elections Results and a Fed Rate Cut, Mortgage Rates Stall

November 14, 2024

After a six-week climb, rates have leveled off, but overall affordability continues to be an issue for potential homebuyers. Freddie Mac’s latest research shows that mortgage payments compared to rents on the same homes are elevated relative to most of the last three decades.

Information provided by Freddie Mac.

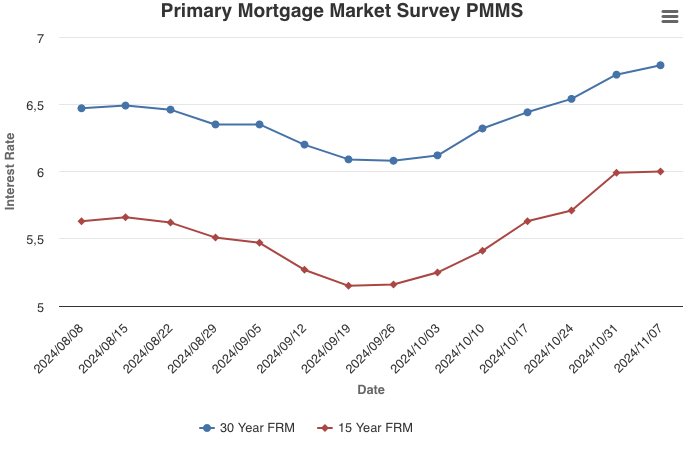

Mortgage Rates Continue to Rise

November 7, 2024

Mortgage rates continued to inch up this week, reaching 6.79 percent. It is clear purchase demand is very sensitive to mortgage rates in the current market environment. As soon as rates began to rise in early October, purchase applications fell and over the last month have declined 10 percent.

Information provided by Freddie Mac.

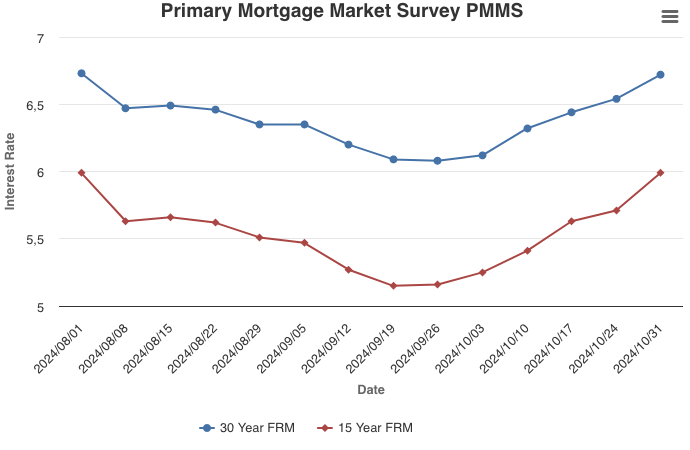

Mortgage Rates Increase for the Fifth Consecutive Week

October 31, 2024

Increasing for the fifth consecutive week, mortgage rates reached their highest level since the beginning of August. With several potential inflection points happening over the next week, including the jobs report, the 2024 election, and the Federal Reserve interest rate decision, we can expect mortgage rates to remain volatile. Although uncertainty will remain, it does appear mortgage rates are cresting, and are not expected to reach the highs seen earlier this year.

Information provided by Freddie Mac.

- 1

- 2

- 3

- …

- 22

- Next Page »