September 1, 2022

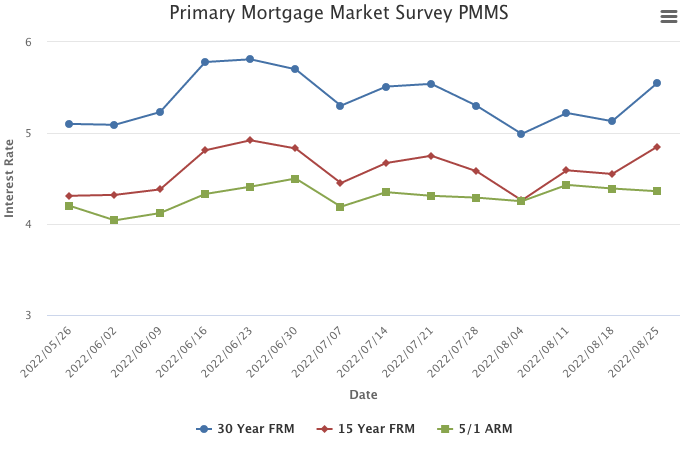

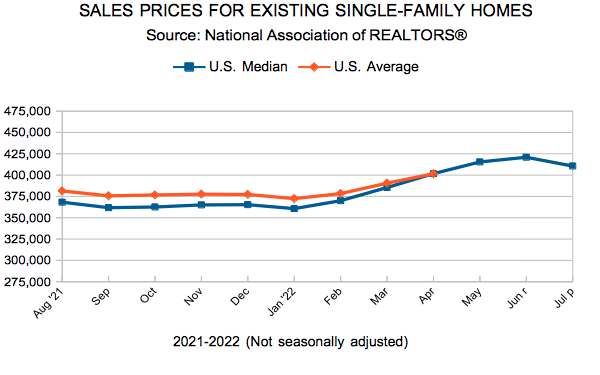

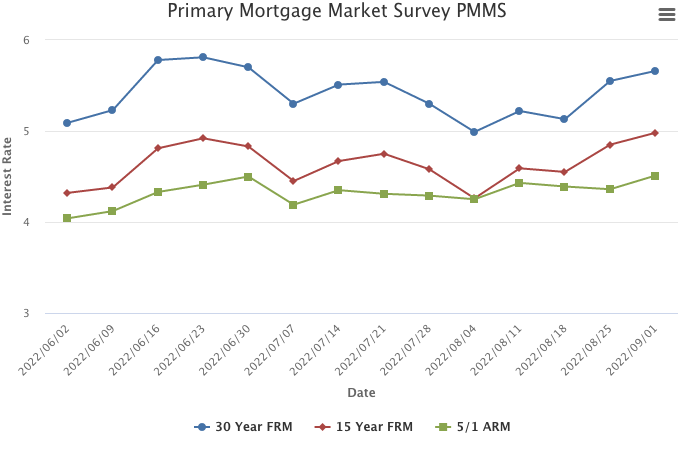

The market’s renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago. The increase in mortgage rates is coming at a particularly vulnerable time for the housing market as sellers are recalibrating their pricing due to lower purchase demand, likely resulting in continued price growth deceleration.

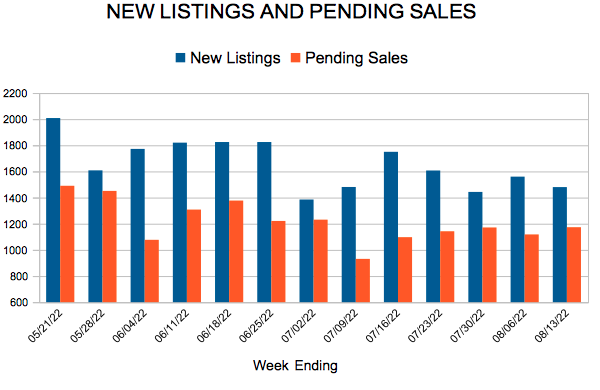

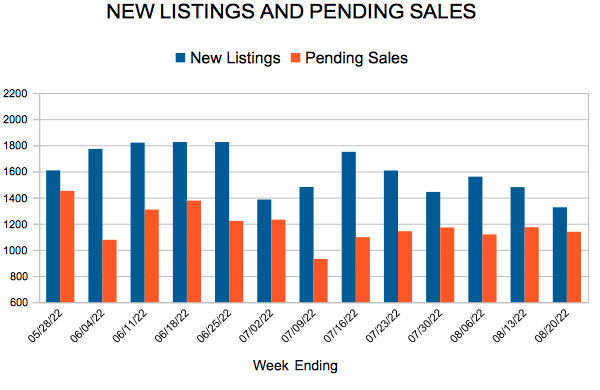

For Week Ending August 20, 2022

For Week Ending August 20, 2022