For Week Ending November 26, 2022

For Week Ending November 26, 2022

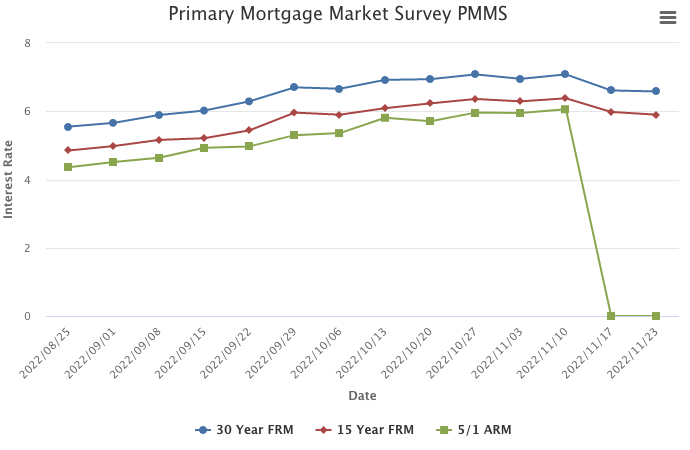

The share of first-time homebuyers has fallen to an all-time low, with first-time buyers making up 26% of all buyers for the fiscal year ending June 2022, while the age of the typical first-time buyer increased to 36 years old, an all-time high, according to the National Association of REALTORS® Profile of Home Buyers and Sellers, which has been published since 1981. Higher borrowing costs and a lack of affordable housing have forced many buyers out of the market this year, and inflation and rising rents have made it more difficult to save up for a down payment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 26:

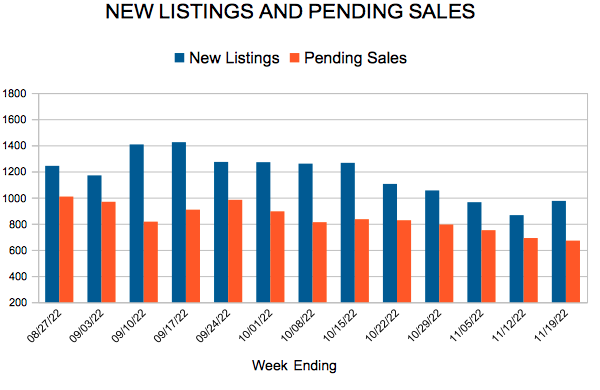

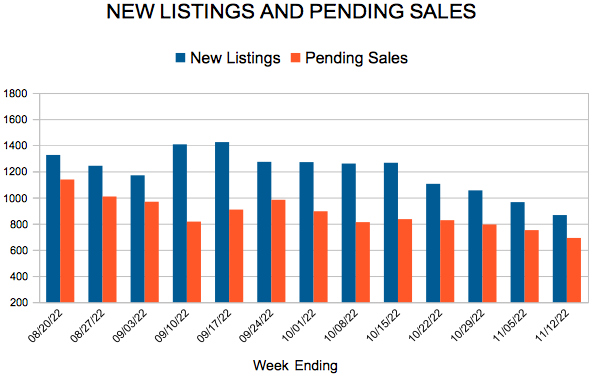

- New Listings decreased 10.4% to 456

- Pending Sales decreased 39.8% to 515

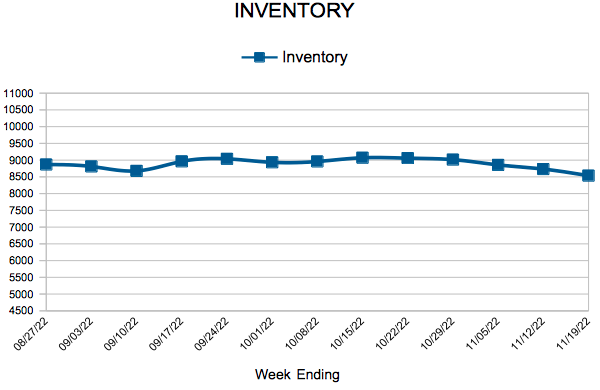

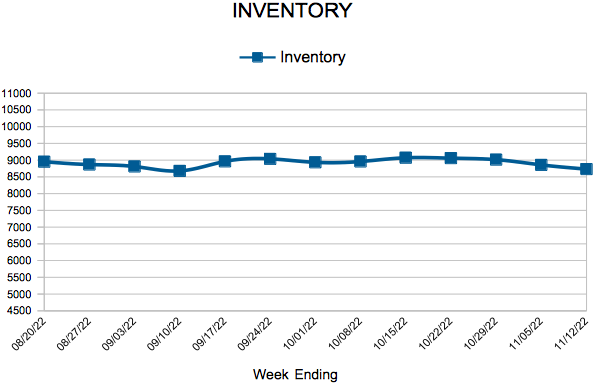

- Inventory increased 12.3% to 8,205

FOR THE MONTH OF OCTOBER:

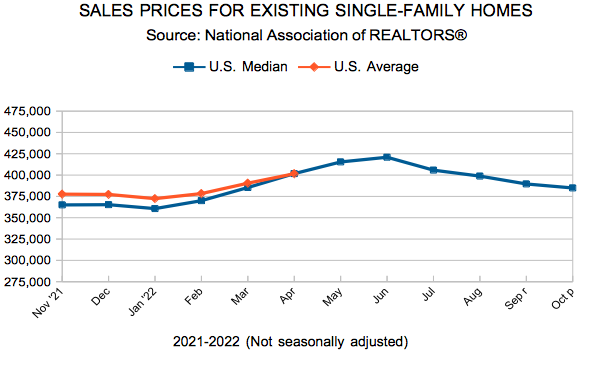

- Median Sales Price increased 4.6% to $355,500

- Days on Market increased 33.3% to 36

- Percent of Original List Price Received decreased 2.0% to 98.3%

- Months Supply of Homes For Sale increased 33.3% to 2.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.