For Week Ending September 30, 2023

For Week Ending September 30, 2023

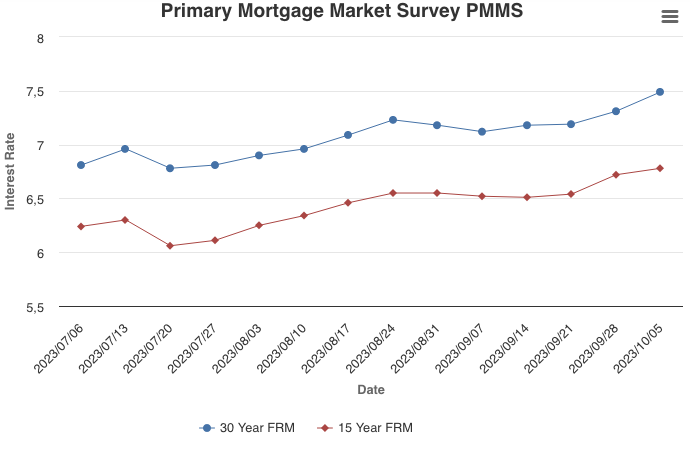

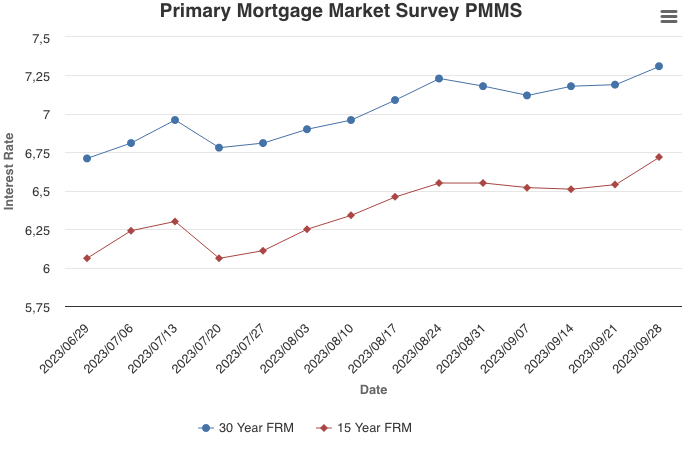

Nationally, pending home sales decreased 7.1% month-over-month as of last measure, falling to the lowest level since April 2020, according to the National Association of REALTORS®, as rising borrowing costs and a scarcity of new listings continue to impact market activity. Pending sales declined in all four regions and were down 18.7% year-over-year, with the smallest monthly declines noted in the Northeast (-0.9%) and the Midwest (-7.0%).

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 30:

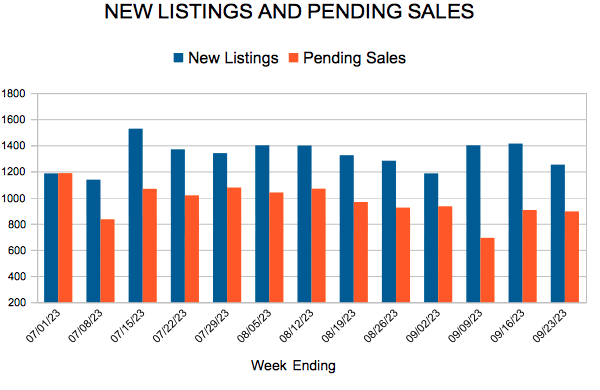

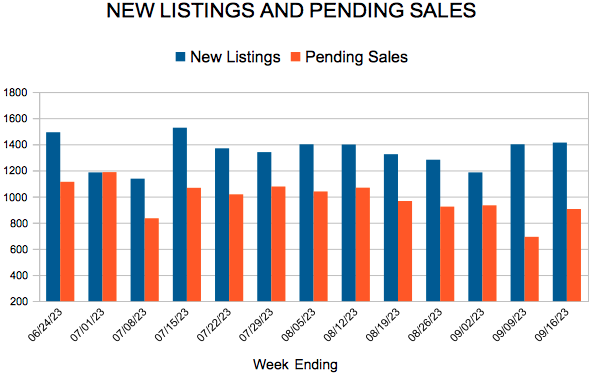

- New Listings decreased 9.8% to 1,174

- Pending Sales decreased 2.0% to 895

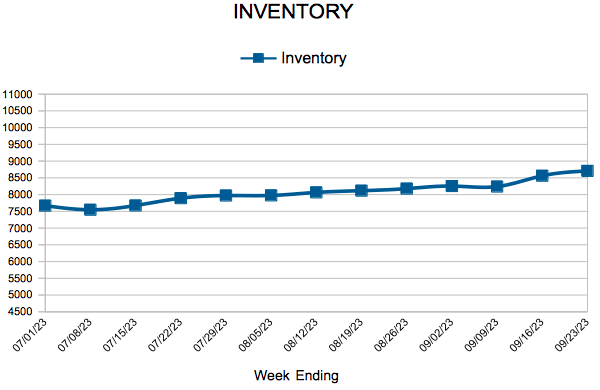

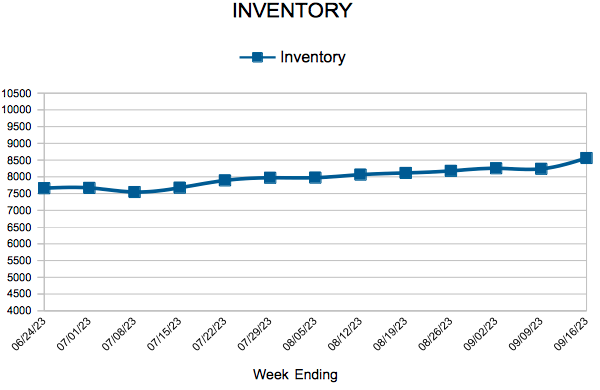

- Inventory decreased 7.4% to 8,732

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 21.1% to 2.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.