March 16, 2023

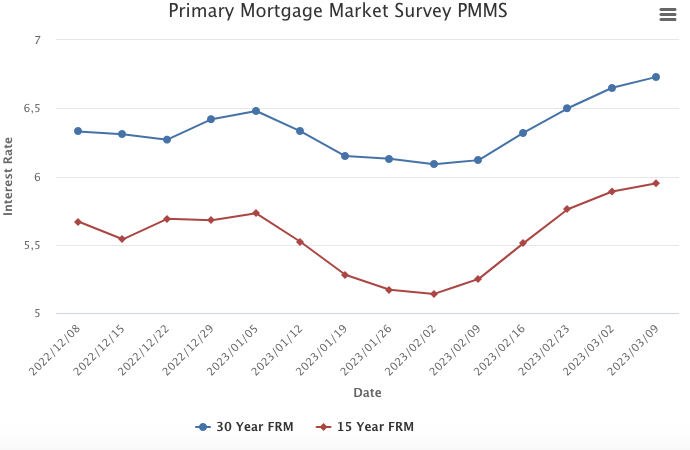

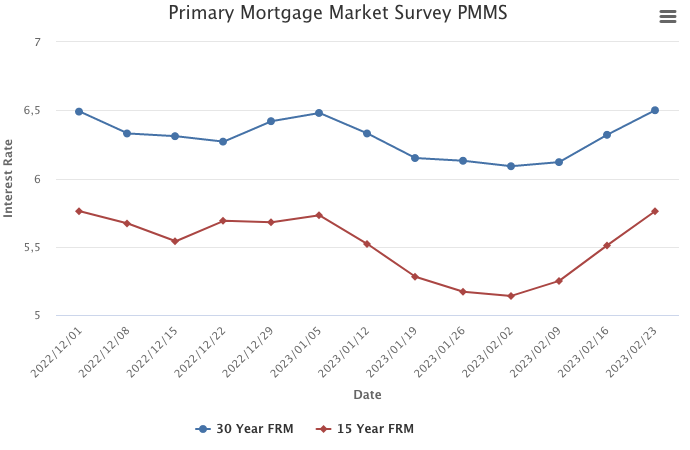

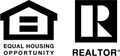

Mortgage rates are down following an increase of more than half a percent over five consecutive weeks. Turbulence in the financial markets is putting significant downward pressure on rates, which should benefit borrowers in the short-term. During times of high mortgage rate volatility, homebuyers would greatly benefit from shopping for additional rate quotes. Our research concludes that homebuyers can potentially save $600 to $1,200 annually by taking the time to shop among multiple lenders.

Information provided by Freddie Mac.

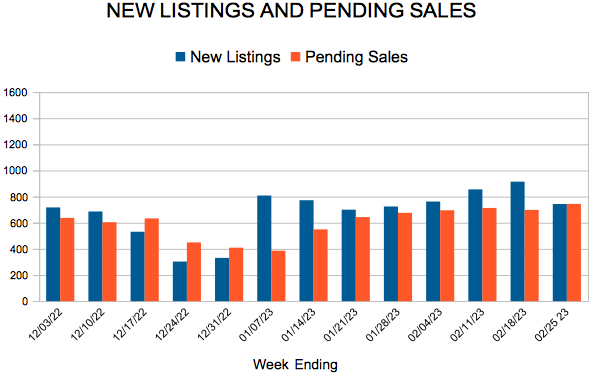

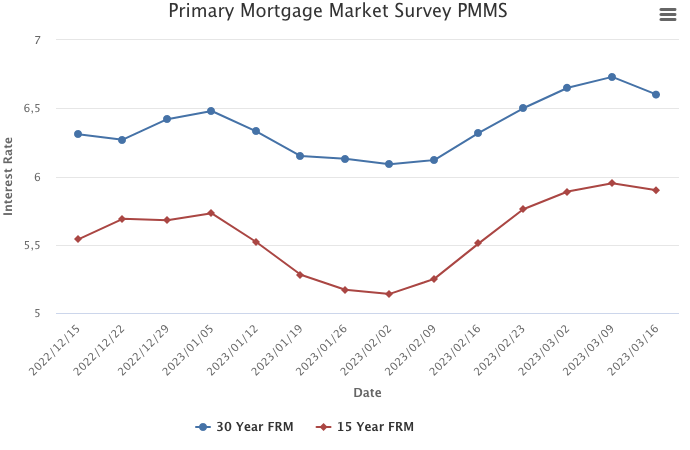

For Week Ending March 4, 2023

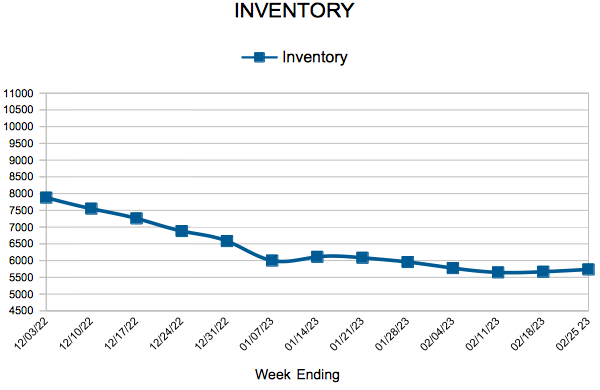

For Week Ending March 4, 2023