For Week Ending April 22, 2023

For Week Ending April 22, 2023

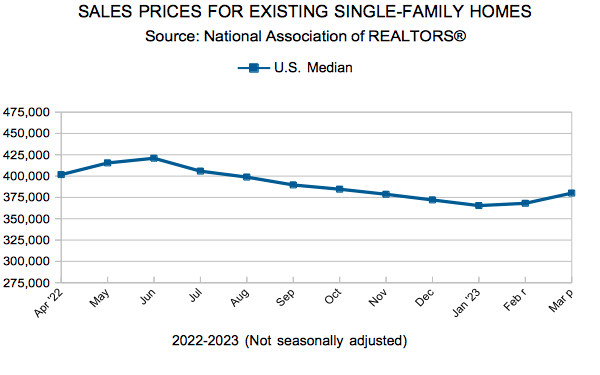

A lack of existing-home supply has allowed U.S. homebuilders to capture a near-record share of housing inventory. According to the National Association of Home Builders (NAHB) Chief Economist Robert Dietz, one-third of current housing supply is new construction, far above the historical norm of 10%. With only 2.6 months’ of existing-home supply as of last measure, prospective buyers have been increasingly turning to the new home market, which, along with builders’ use of sales incentives, have helped support new home sales in recent months.

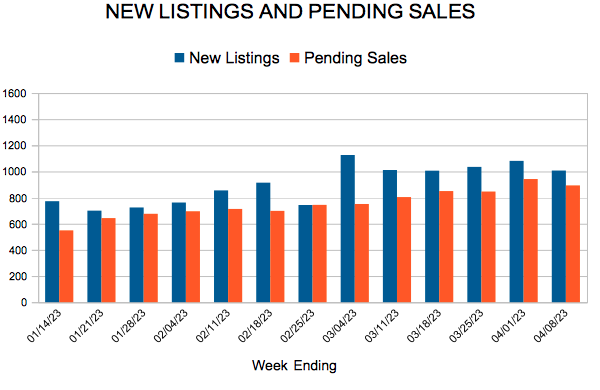

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 22:

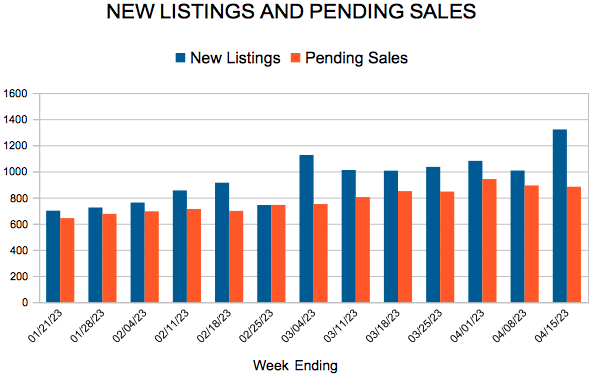

- New Listings decreased 27.0% to 1,344

- Pending Sales decreased 17.0% to 975

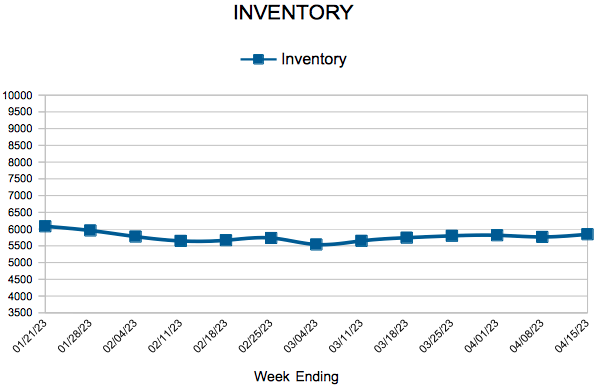

- Inventory increased 5.0% to 6,065

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.