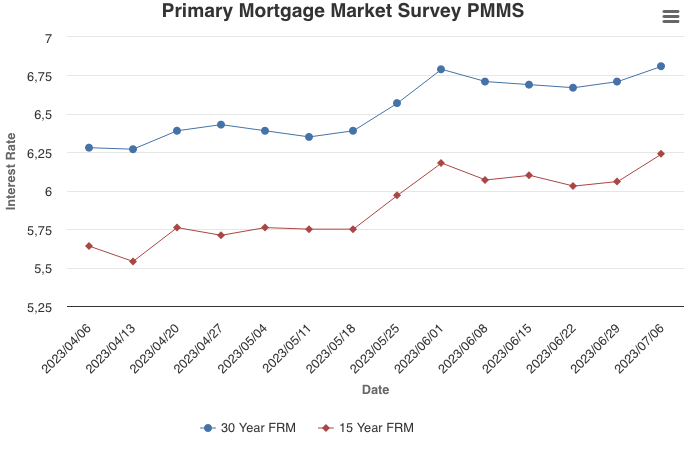

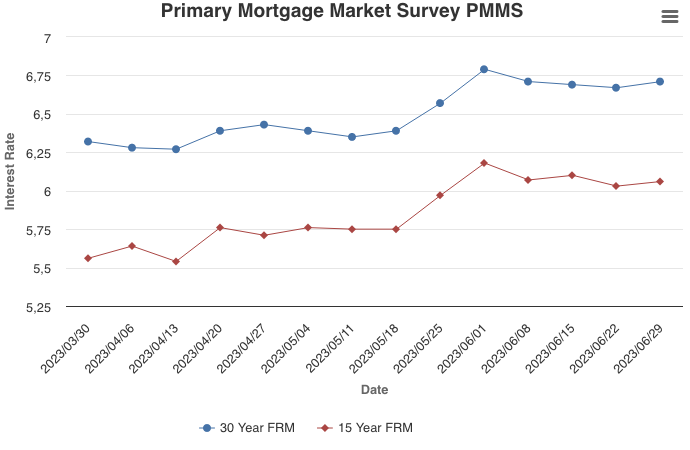

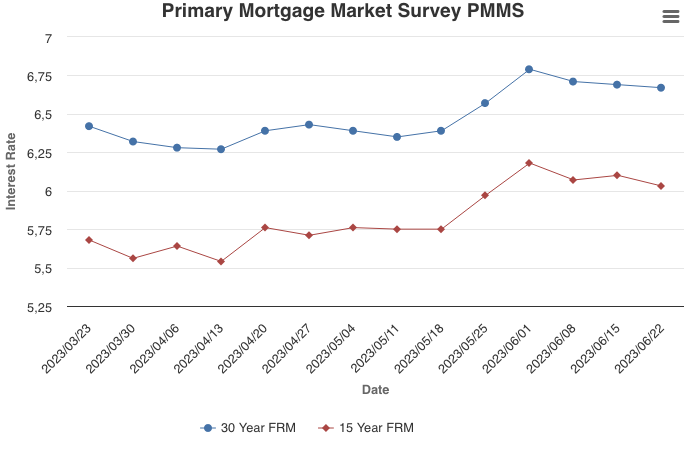

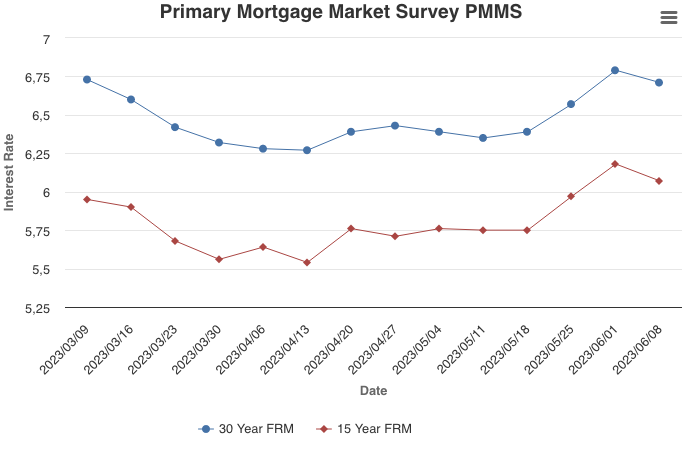

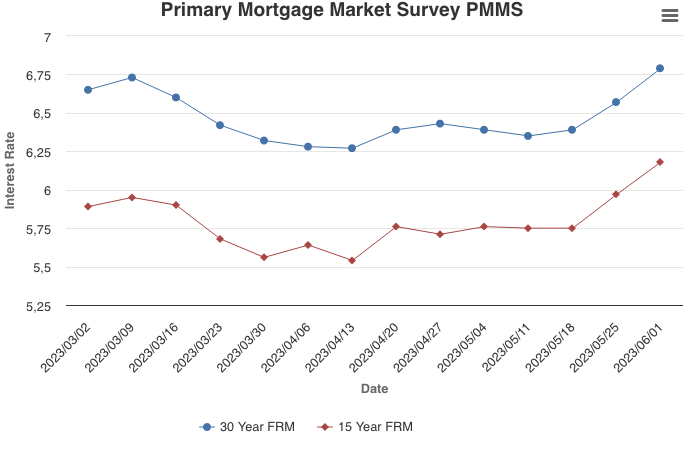

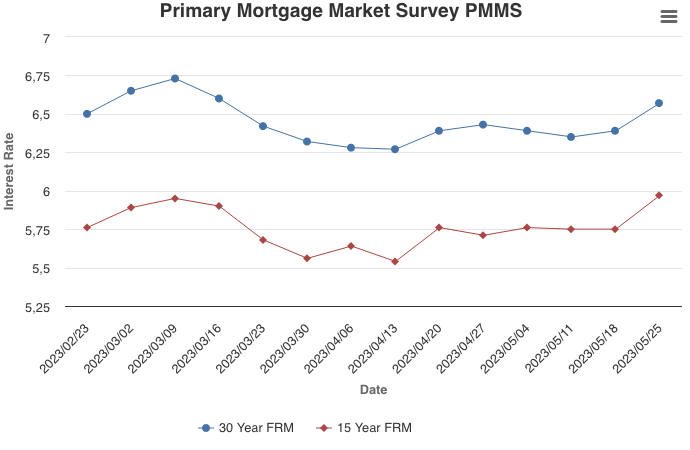

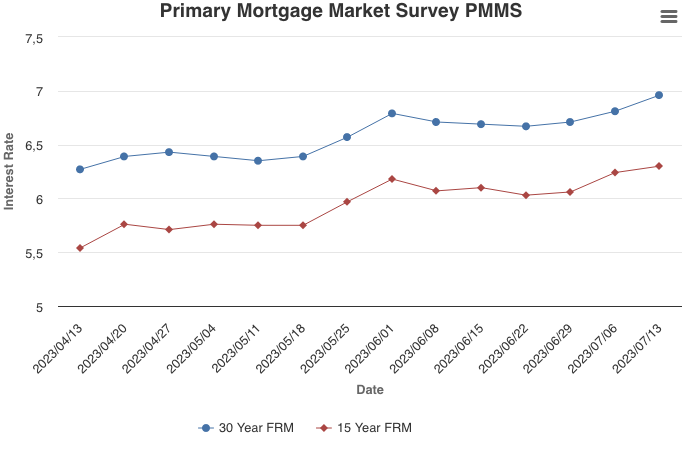

July 13, 2023

Mortgage rates increased to their highest level since November 2022, the last time rates broke seven percent. Incoming data suggest that inflation is softening, falling to its lowest annual rate in more than two years. However, increases in housing costs, which account for a large share of inflation, remain stubbornly high, mainly due to low inventory relative to demand.

Information provided by Freddie Mac.