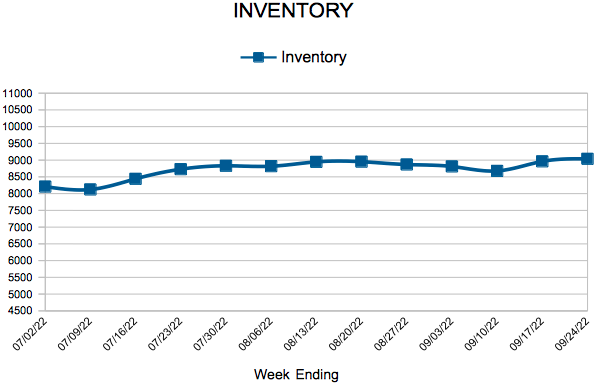

Inventory

Weekly Market Report

For Week Ending October 1, 2022

For Week Ending October 1, 2022

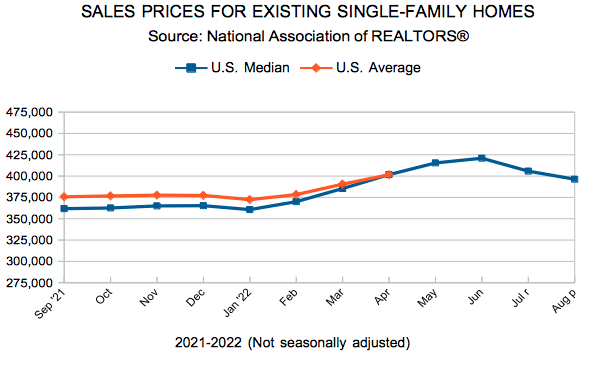

U.S. home prices are falling at the fastest rate since January 2009, according to recent data from Black Knight, as shifting market conditions have led many sellers to lower their asking price. Nationally, median home prices fell by 0.98% from July to August, marking the second consecutive month prices have declined. Although home prices are down 2% from their peak in June, they remain up 12.1 % compared to the same period last year.

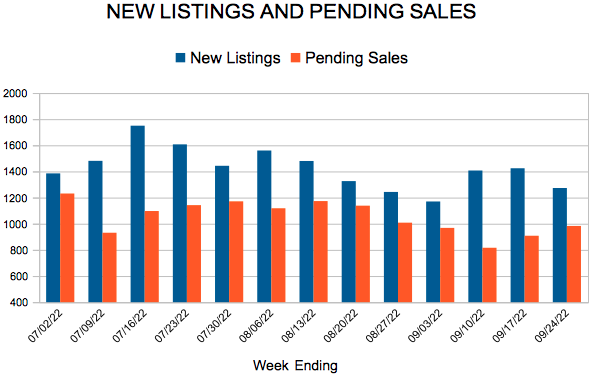

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 1:

- New Listings decreased 20.0% to 1,271

- Pending Sales decreased 36.5% to 895

- Inventory decreased 0.8% to 8,934

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

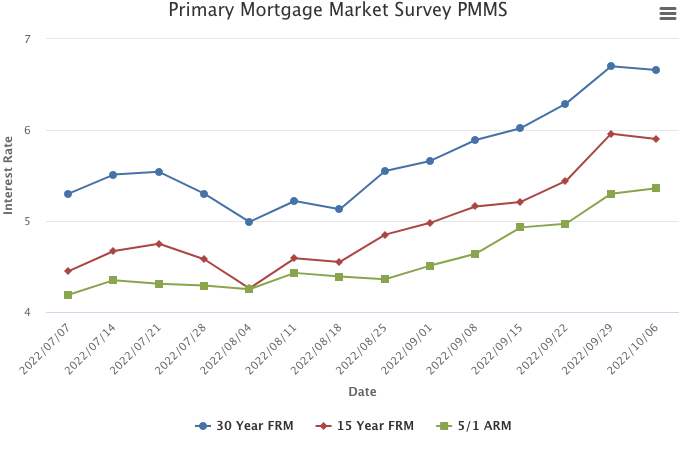

Mortgage Rates Decrease Slightly

October 6, 2022

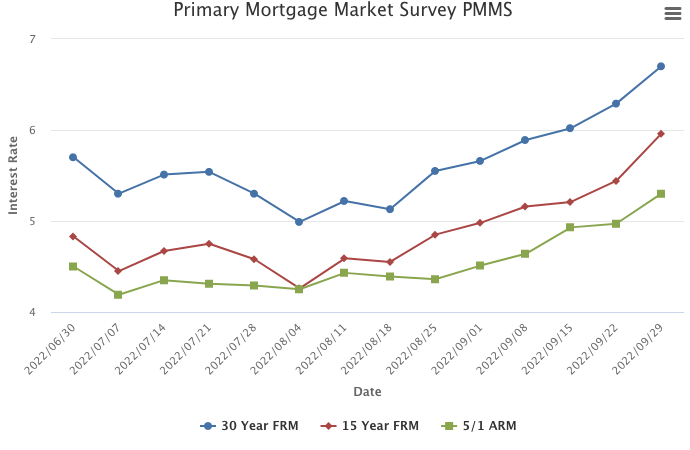

Mortgage rates decreased slightly this week due to ongoing economic uncertainty. However, rates remain quite high compared to just one year ago, meaning housing continues to be more expensive for potential homebuyers.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 24, 2022

For Week Ending September 24, 2022

Lumber prices plunged to their lowest level in more than two years following the Federal Reserve’s 75-basis-point rate hike last week, as soaring mortgage interest rates and the slowdown in the US housing market have caused lumber demand to cool rapidly this year. The Wall Street Journal reports lumber futures are down about one-third from a year ago and have fallen more than 70% from this year’s peak in March.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 24:

- New Listings decreased 20.2% to 1,273

- Pending Sales decreased 29.4% to 983

- Inventory increased 0.4% to 9,039

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Rise for the Sixth Consecutive Week

September 29, 2022

The uncertainty and volatility in financial markets is heavily impacting mortgage rates. Our survey indicates that the range of weekly rate quotes for the 30-year fixed-rate mortgage has more than doubled over the last year. This means that for the typical mortgage amount, a borrower who locked-in at the higher end of the range would pay several hundred dollars more than a borrower who locked-in at the lower end of the range. The large dispersion in rates means it has become even more important for homebuyers to shop around with different lenders.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 36

- 37

- 38

- 39

- 40

- …

- 85

- Next Page »