For Week Ending January 28, 2023

For Week Ending January 28, 2023

U.S. housing starts declined in 2022, as homebuilders scaled back production due to high construction costs, affordability challenges, and a pullback in buyer demand. According to the U.S. Census Bureau, 1.55 million homes were started last year, a 3% drop from the previous year, and the first annual decline since 2009. However, housing completions increased, with 1.39 million homes completed in 2022, a 3.8% increase from the previous year, when 1.34 million homes were completed.

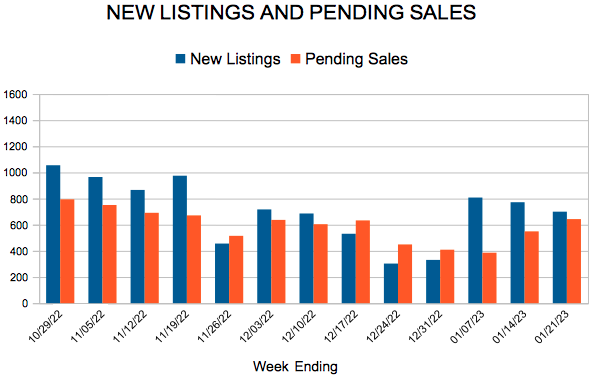

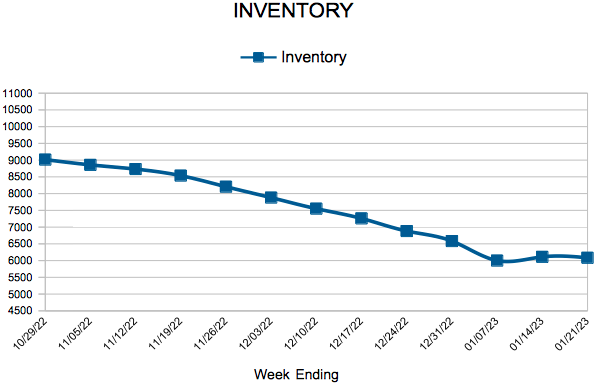

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 28:

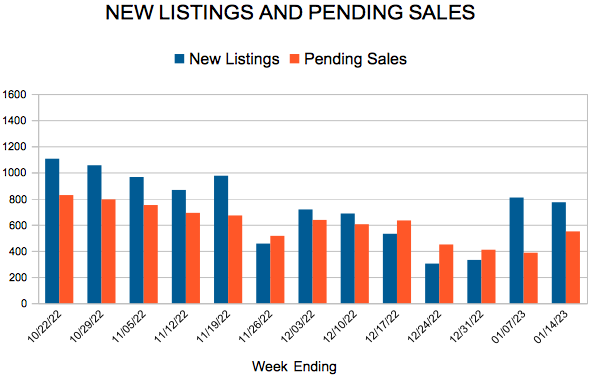

- New Listings decreased 17.5% to 724

- Pending Sales decreased 17.8% to 676

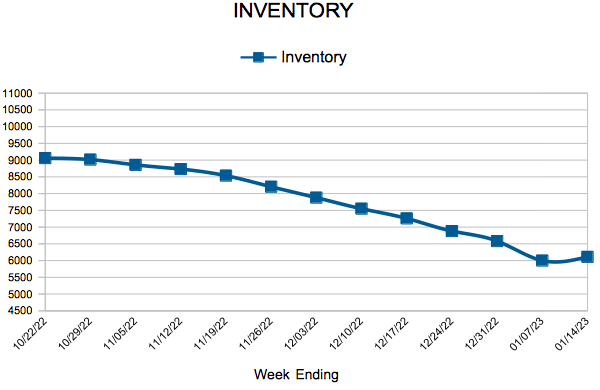

- Inventory increased 20.4% to 5,957

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 5.1% to $348,320

- Days on Market increased 47.1% to 50

- Percent of Original List Price Received decreased 3.2% to 96.3%

- Months Supply of Homes For Sale increased 55.6% to 1.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.