Weekly Market Report

For Week Ending December 31, 2022

For Week Ending December 31, 2022

Rental prices are rising at the slowest pace in 19 months, with rents up 3.4% nationally as of last measure, marking the 10th consecutive month of slowing rent growth, according to Realtor.com’s recent Rental Report. Among the 50 largest metropolitan markets, the median asking rent declined $22 month-to-month to $1,712 and was down $69 from July 2022’s peak of $1,781. Rents in Sun Belt markets slowed at a faster rate than rents in the Midwest and in big metros such as Boston, Chicago, and New York, which have seen stronger rental growth this year.

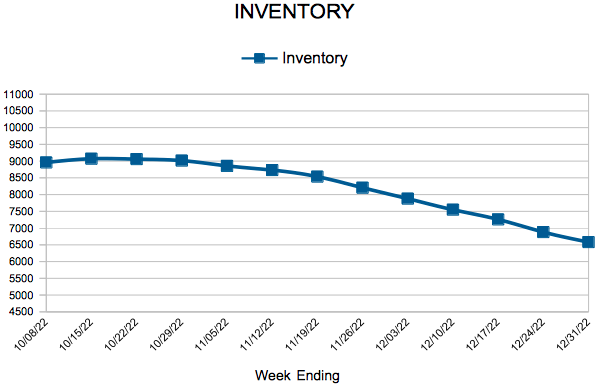

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 31:

- New Listings decreased 22.7% to 331

- Pending Sales decreased 29.0% to 409

- Inventory increased 20.2% to 6,582

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.4% to $354,900

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 24, 2022

For Week Ending December 24, 2022

Elevated mortgage rates continue to take a toll on the construction industry, with housing permits for new homes falling 11.2% in November, according to the Commerce Department. Housing starts were down 0.5% over the same time period, with the annual rate of housing starts down 16.4% from the previous year. Overall construction was strongest in the West and the South, while single-family construction was strongest in the West and Northeast.

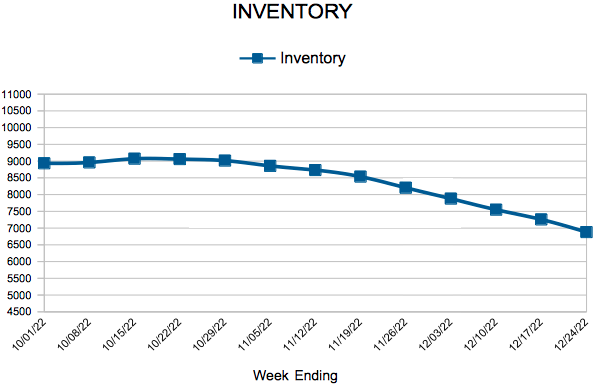

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 24:

- New Listings decreased 5.6% to 303

- Pending Sales decreased 20.8% to 449

- Inventory increased 18.8% to 6,881

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 17, 2022

For Week Ending December 17, 2022

Mortgage rates continued their downward trend of recent weeks, as the 30-year fixed-rate mortgage averaged 6.31% the week ending 12/15, according to Freddie Mac. Mortgage rates have fallen for the past 5 weeks, declining by more than three-quarters of a percent in that time, and are at their lowest level since September. The drop in rates has resulted in an uptick in mortgage refinance demand, which increased 6% from the previous week, according to the Mortgage Bankers Association.

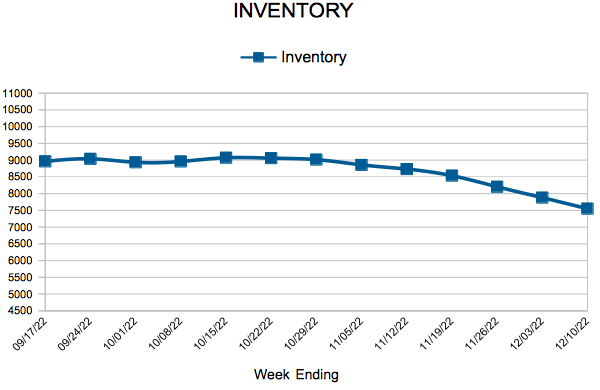

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 17:

- New Listings decreased 11.1% to 531

- Pending Sales decreased 23.2% to 633

- Inventory increased 17.1% to 7,258

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 10, 2022

For Week Ending December 10, 2022

Conforming loan limits on mortgages acquired by Fannie Mae and Freddie Mac will increase in most of the United States to $726,200 in 2023, up from $647,200 in 2022, according to the Federal Housing Finance Agency. Meanwhile, the conforming loan limit in high-cost areas will increase to $1,089,300, exceeding the $1 million dollar mark for the first time. The increases in loan limits will allow a larger group of borrowers to qualify for loans backed by Fannie Mae and Freddie Mac.

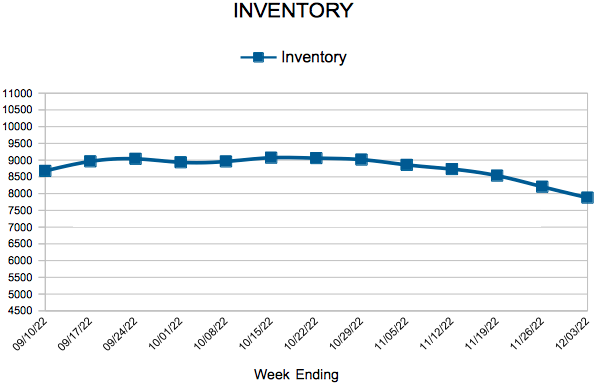

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 10:

- New Listings decreased 4.1% to 686

- Pending Sales decreased 27.1% to 604

- Inventory increased 15.5% to 7,549

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 41.7% to 1.7

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 3, 2022

For Week Ending December 3, 2022

Rising interest rates and higher sales prices have caused affordability to decline significantly this year, and U.S. homebuilders have taken note. New homes have been getting smaller throughout 2022, with the U.S. Census reporting the median square footage of homes under construction was 2,276 in the third quarter of 2022, down 2.5% from the fourth quarter of 2021, when the median square footage was 2,335. The trend toward smaller homes is expected to continue in the months ahead, as homebuyer budgets remain constrained.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 3:

- New Listings decreased 18.8% to 717

- Pending Sales decreased 34.3% to 637

- Inventory increased 14.4% to 7,879

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 4.6% to $355,500

- Days on Market increased 33.3% to 36

- Percent of Original List Price Received decreased 2.0% to 98.3%

- Months Supply of Homes For Sale increased 33.3% to 2.0

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 12

- 13

- 14

- 15

- 16

- …

- 40

- Next Page »