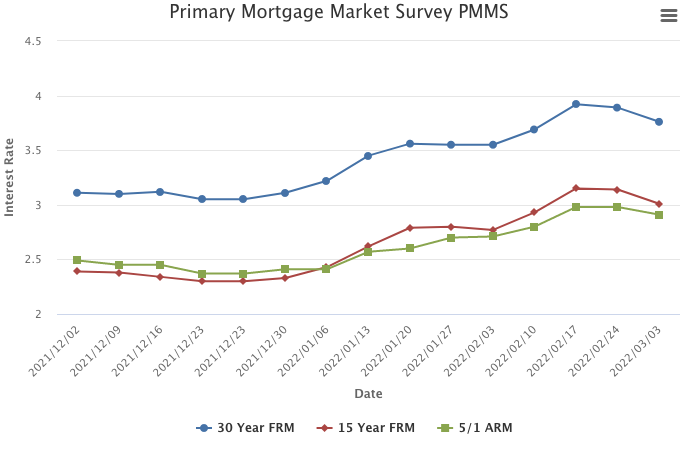

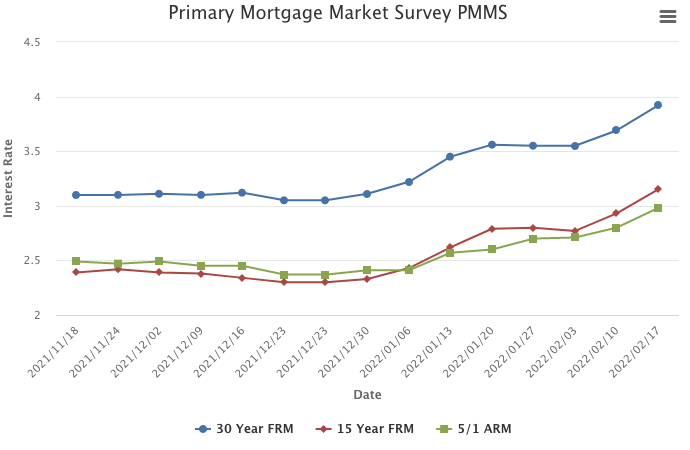

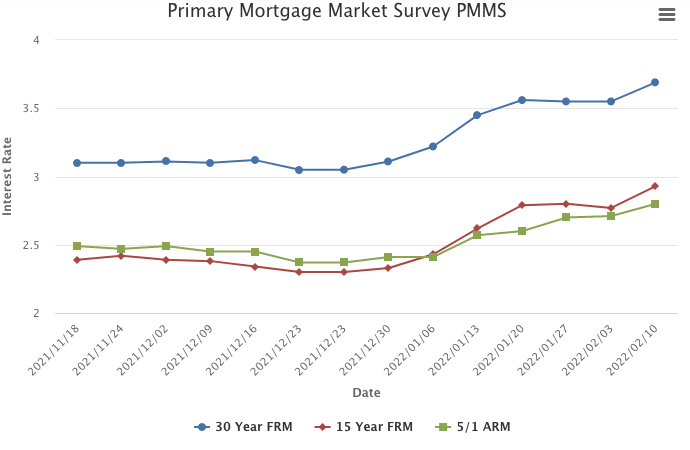

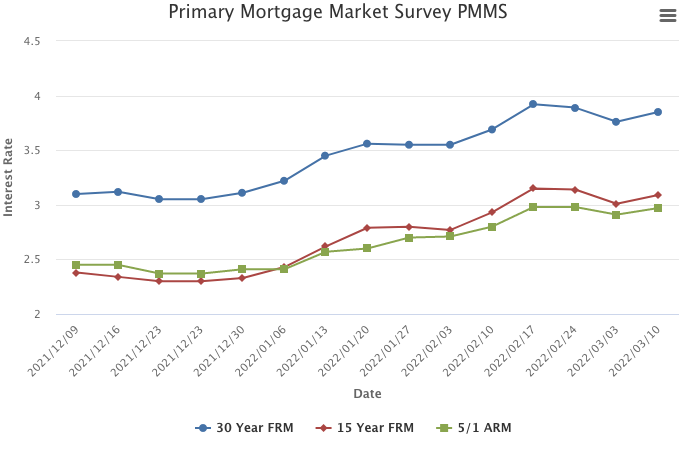

March 10, 2022

Following two weeks of declines, mortgage rates rose this week as U.S. Treasury yields increased. Over the long-term, we expect rates to continue to rise as inflation broadens and shortages increasingly impact many segments of the economy. However, uncertainty about the war in Ukraine is driving rate volatility that likely will continue in the short-term.

Information provided by Freddie Mac.